Waiting for Godot: Summary

- Though the euphoria of the reopening has largely peaked out, the world is nowhere near back to normal: global interconnectedness is continuing to wreak havoc on supply chains while demographics are coming home to roost, all of which are feeding inflation.

- Equity market valuations are relentlessly looking past the current disruptions with the assumption that the world WILL return to normal: valuations can remain elevated if the future growth is expected to offset current losses; however, the growth in earnings growth is expected to naturally slow from here making valuations feel a bit expensive.

- Meanwhile, if inflation proves to be persistent, it could become problematic for the Fed to keep supplying liquidity to an the overly indebted government and corporate sectors: a significant shift away from easy monetary policy is not priced into either the debt or equity markets.

Market Review: Earnings to the Rescue

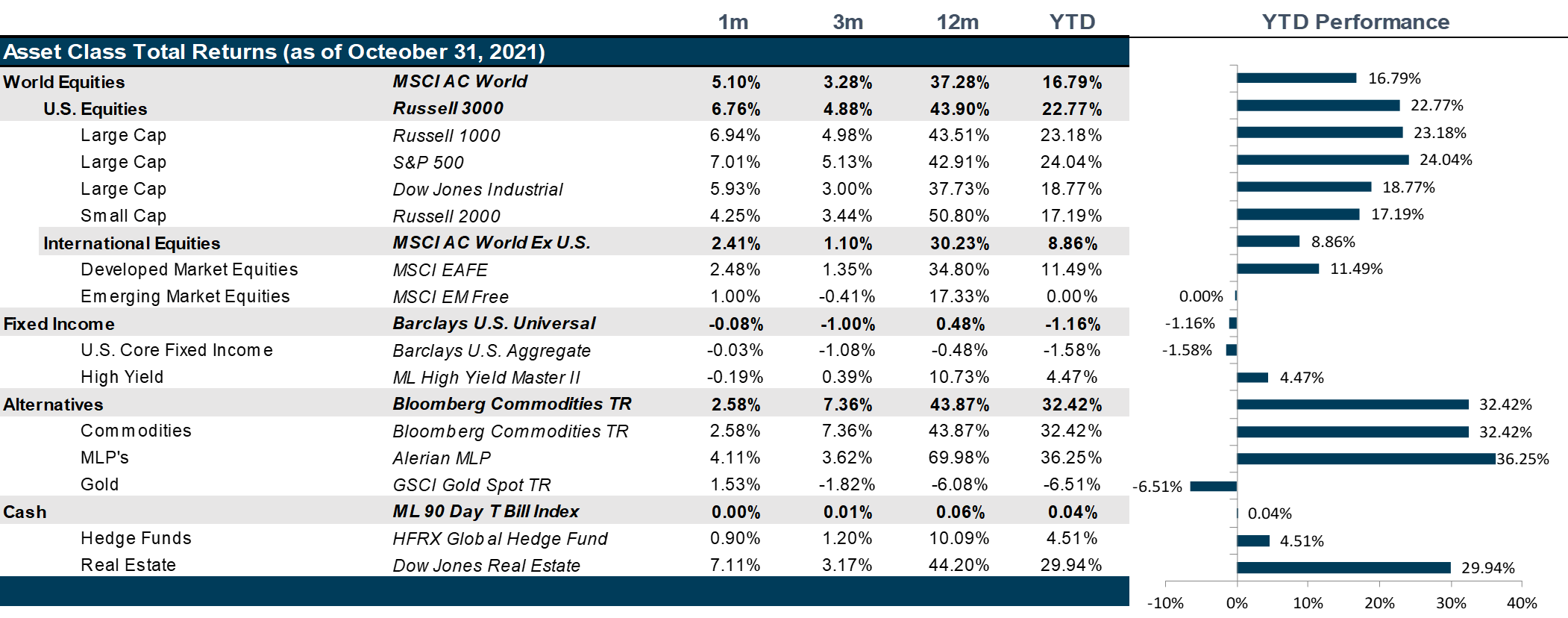

October witnessed poor economic growth numbers and political disarray offset by better-than-expected earnings results.

U.S. markets were tumultuous in the first half of October as bond yields steepened and global energy prices soared. In addition, worries lingered regarding the scale of the Evergrande debt crisis and possible spillover effects as U.S institutions rushed to mitigate their exposures. Congress passed a stopgap bill to postpone the debt ceiling to December however Democrats were unable to muster the votes to pass President Biden’s ambitious infrastructure and social spending bill despite major cuts (A watered down version of the infrastructure bill passed and was signed by the president on 11-15-2021). Nonfarm payroll numbers for September disappointed again, reporting an addition of just 194,000 jobs to the economy, short of the estimated 500,000. While jobless claims numbers have continued to fall throughout the month, a reported rise in inflation, continuing supply chain woes and expectations of a Fed taper with lackluster third quarter earnings led to a selloff in equity markets. The selloff reversed in the second half of the month as the third quarter earnings season got underway with big banks posting results exceeding expectations. Market sentiment improved as bank results revealed a healthy growth in deposits and loan balances. By the end of the month, nearly 50% of the companies with the S&P 500 had reported their quarterly results and close to 80% of them beat their earnings estimates. Companies however have continued to report rising inflation and continued disruptions in the supply chain affecting their bottom lines and have cut back their outlooks.

European markets experienced a bout of volatility towards the first half of the month from the deepening energy crisis and soaring commodity prices. However, they enjoyed a resurgence and the STOXX Europe 600 gained 4.4% over the month on the back of a strong earnings season. Japan’s Nikkei 225 continues to be impacted by the Evergrande debt crisis.

Emerging markets briefly recovered in October; however, the real estate crisis in China brought to the forefront by the Evergrande Group defaulting on its debt, continues to rattle the Asia Pacific region. MSCI China has continued on a downward trend since peaking in February as the government continues to crackdown on private sectors, and combat covid infections in a fervent manner, introducing widescale lockdowns at the slightest spread. The recent energy crisis resulted in slowdown of industrial production; however, investments have continued to pour in as the pummeling has resulted in Chinese equities exhibiting much more attractive valuations compared to the counterparts elsewhere. Over the past month, Russia and the Middle East continue to be the top performers due to being net exporters of oil, while inflation concerns continue hurt Latin America.

The belly of the yield curve continued to steepen in October as the long and short end of the curve remained largely unchanged. The Federal Reserve confirmed the start of the bond tapering process towards the end of the month and Chairman Jerome Powell emphasized on rate hikes being independent of the tapering process, to prevent any sudden lurches in the bond market. Markets continue to buy into the idea of transitory inflation; however, the supply chain disruptions and the poor growth of the job market has resulted in expectations of a quicker rate hike that has pushed up rates in the belly of the yield curve.

WTI Crude Oil prices rose from $75.73 to $83.57 in October. OPEC+ has so far resisted pressure to loosen supply curbs and continues to raise output cautiously. Copper futures peaked mid-October, rising to $4.75 per pound before falling to $4.4 towards the end of the month as China’s manufacturing sector slowed, despite near multi-decade low inventories. Raw sugar future prices have also surged to beyond $0.19 per pound, touching levels last observed in late 2016. Brazil, the world’s largest producer of sugar has seen cane-sugar crops being impacted by prolonged dry weather and frosts. To compound misery, surging oil prices have incentivized sugar mills to increase production of cane-based ethanol instead. Similarly, a combination of inflation in food prices and low supplies due to adverse weather conditions , as well as soaring demand has pushed prices of wheat futures to $7.7 per bushel, nearing levels last observed in 2012-13.

Going Forward: Waiting for Godot

October always feels scary, but statistically, the chances are not different than any other month to be the worst month of the year. And yet, here we are staring down what feels like a tsunami of risks that just hit the economic ocean shelf of recovery and has built up to monumental heights quickly. So, will this pass or will there be significant destruction as total COVID deaths have now surpassed five million, though that is generally accepted to be an underreported number? That said, the world has produced abundant testing methods, multiple vaccinations, and now multiple effective treatment options. For various reasons, these resources are neither equally shared among those who desire to partake and not fully exploited by those with access. Regardless of the reasons, the result has been a steady stop and go recovery that has yet to materialize into the grand “reopening” that we all had hoped for. In fact, many market and business observers agree that the world has changed forever as a result of the pandemic. But the markets are still waiting for Godot. Evidence can be seen in valuations which have a been most unusually patient with the effects of lockdown, illness, and lack of activity, blithely assuming that the world will indeed return to normal. And, yet one of our most sacred assumptions is looking like it may be breached: the notion that falling demographics coupled with continuous innovation will continue to keep a lid on inflation, allowing the government to keep interest rates low for decades and allowing the U.S. government and corporate complex to borrow limitlessly and cheaply. More importantly, globalization would allow corporate margins to increase to support the debt loads while pulling poorer countries out of poverty. But, nowhere in that arithmetic, did any economist allow for a global test of the supply chains created by such interconnectivity and nor did any economist imagine a health threat that would linger for more than 24 months. So, here we are, attempting to emerge from the pandemic, but still unsure if life will ever get back to normal and facing prices for market assets that are simply assuming that they will.

Was that it?

Because of vaccinations, the recovery cycle is out of sync globally with China entering recovery first, followed by the U.S., then Europe, and finally Japan. However, many emerging market countries such as Vietnam or Peru are still struggling to vaccinate their populations and are stuck in lockdowns and the outlook for the recovery of EM’s is still The peak of growth expectations has had a largely disappointing feel to it. We are now past the highest growth we will ever experience in history and the recovery remains uneven and not quite done. While some sectors hardly skipped a beat like communications and technology, other sectors are nowhere near normal. Earnings growth has hit its peak as well and is expected to slow, partially because of supply chain disruptions and partially because the Delta variant acted like a wet blanket on the economy to remind us that COVID is not quite yet a non-event. Moreover, valuations do reflect any kind of new normal. If anything, prices remain high as if there is more to come. Growth has mostly remained in favor, even in the COVID downturn, suggesting that the equity markets are not concerned about current valuations. Godot will come.

Inflation

Perhaps the greatest threat to a successful and smooth recovery remains the supply demand mismatch between the recovery in countries that primarily consume goods and those that primarily produce goods. The lack of vaccinations for poorer manufacturing countries like Vietnam and Indonesia are to blame for the inability to stock inventories for manufacturers of everything, from cars, to toys, to shoes, to clothing, to electronic goods. This also extends to mines . Several factors have met to create momentum in inflation, a notion that at one time was considered extinct for a variety of reasons like demographics and innovation, both of which should be deflationary over time. However, the pandemic exposed a lack of resilience in the relationship between countries in the face of public health, public safety and resource scarcity. All countries watched out for their own, leaving the global supply chain that depends on global cooperation suddenly hobbled by inwardly oriented and non-cooperative policies. This test may mark a step away from globalization. However, without globalization, access to large, young and cheap offshore workforces will ensure that inflationary pressures may remain or at least that the stepwise shift up in intermediate costs as corporations consider onshoring manufacturing will put a dampener on margins. To add more fuel to the fire, the mass retirement of segments of the boomer population, urged by COVID has resulted what is shaping up to be a permanent shift down in the labor force participation rate. The sudden loss of labor has dramatically shifted the balance of power between labor and capital. While capital has milked labor for every last ounce of productivity, labor seems to be flexing its newfound muscles and we are now witnessing a dramatic rise in the growth of low skill worker wages relative to high skill worker wages. Though wage growth at the lowest wages often has the highest money velocity, the impact to money velocity has yet to be seen.

A Question of Liquidity

Global monetary policy is becoming less supportive with countries already announcing the end of pandemic stimulus and teasing rate hikes in 2022, now currently priced into the Fed Funds Futures market. This alone should create yield competition for assets. However, the ongoing debt-ceiling battle, drawn along party lines may threaten the very fabric of risk by throwing in the possibility of the first ever U.S. default. Keep in mind that when the U.S. lost its AAA rating in August of 2011, equity markets were flat for the remainder of the year and then shrugged it off for a stellar 2012. In addition, keep in mind that being at the bottom of the capital structure seems to ensure a very short-term memory when it comes to risk as long as crisis can be averted. However, traditionally in tightening environments, the outcome for equities can be good but not great while returns in fixed income markets over the same period can be very While I have always been a fan of productive inflation, which is inflation that passes through wages rather than through asset prices, perhaps the most concerning side effect may be that persistent wages could herald a shift away from extreme liquidity that has propped up market valuations for the better part of two decades. And, if that is the case, it will occur at a highly indebted moment in government and corporate balance sheets. Though there are certainly global forces that could keep the markets from an all-out revolt, the markets could still enter a volatile period until we can see the end to the current bout of inflation. More importantly, I am not entirely sure that the average investor appreciates the massive liquidity the Fed brings to the market through their balance sheet expansion and bond purchasing. As that liquidity is pulled back from the markets globally, we are also forgetting that the Great Financial Crisis largely hollowed out bank proprietary trading desks as sources of liquidity. The great question we should all be asking ourselves is: who will supply liquidity to the very large bond market if not the Fed or the bank trading desks?

Net View

We remain neutral in U.S. equities on size and style. We also remain underweight in Emerging Markets relative to the U.S. and remain overweight in Europe to Japan.