This month, we focus on the outlook for 2021 in the wake of a new political administration, a vaccine, and current market valuations. We considered several possible scenarios regarding the rollout of the vaccine, additional stimulus, and other policy changes that could shape the recovery of the U.S. economy. Our goal is not to predict outcomes, but rather to highlight the risks and opportunities of various circumstances.

Road to Recovery: Summary

- The road to recovery looks priced into markets: however, at the sector and security levels, the averages hide extreme over- and under-valuations. While the outlook for expected returns in 2021 is flat to slightly positive, the outlook for expected volatility is quite high, in our opinion.

- Don’t ignore public policy: a new administration takes the helm, emboldened with a slim mandate in both the House and the Senate. Watch for policies around climate change, infrastructure, taxes, and business investment to have impacts on market winners and losers.

- COVID is not over yet: while the markets are quick to look past the current pandemic to the recovery, we must not forget that we still face logistical, fiscal, and policy issues with mass vaccination and continued spread, which are expected to create headlines for at least six months or longer.

Market Review: Light at the End of the Tunnel

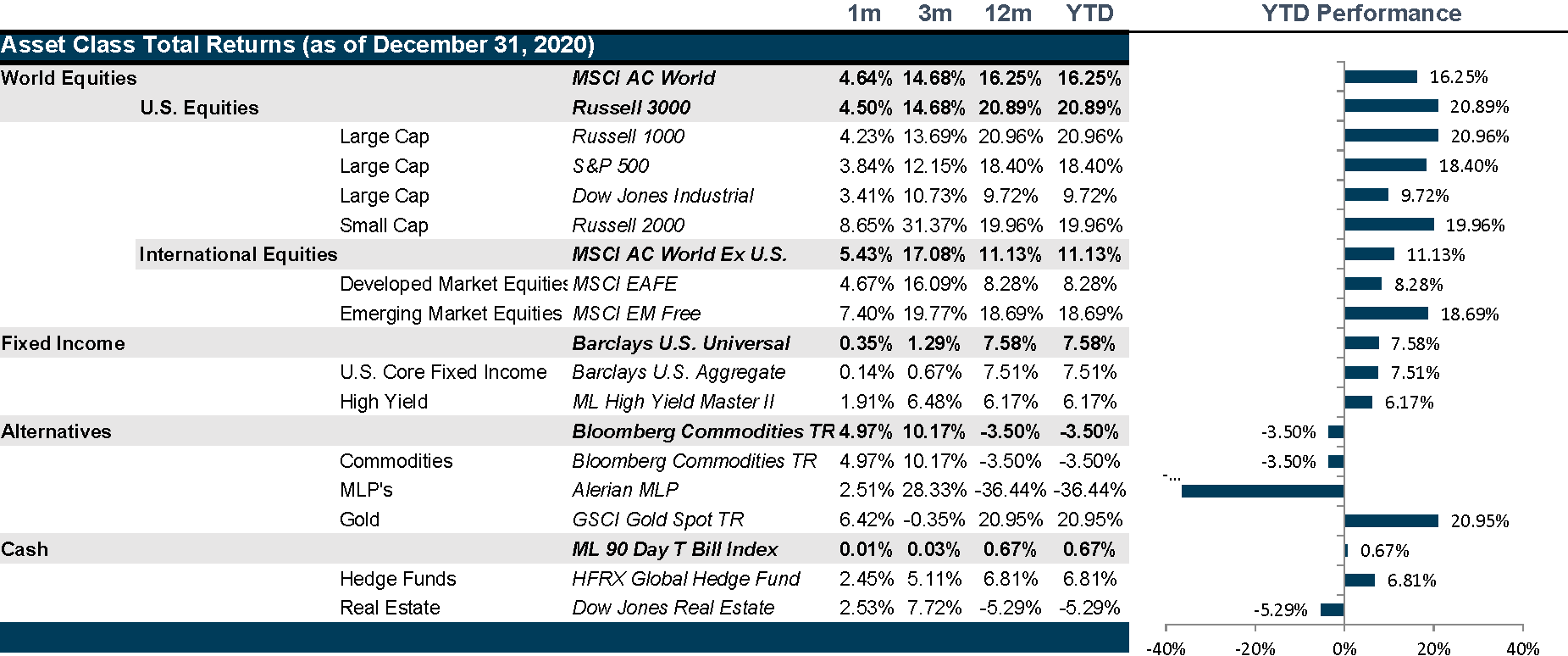

Vaccine distribution and stimulus supported markets while Brexit, a more transmissible strain of COVID, and a deadly pandemic wave moderated market optimism in December.

U.S. equity markets ended December in positive territory, though not without gyrations during the first half of the month as coronavirus cases continued to surge across the country and Congress continued to experience setbacks in finalizing the terms of the second stimulus bill.

In addition, the Federal Trade Commission and the Department of Justice filed anti-competitive and antitrust lawsuits against Facebook and Google, respectively, driving the technology sector and overall markets lower.

However, markets rebounded in the latter half of the month as the FDA provided emergency approval to two vaccine candidates and Congress finally passed a much-delayed stimulus bill with bipartisan support despite President Trump’s initial rejection of the bill. In addition, Tesla was added to the S&P500 index under the Consumer Discretionary sector in one-go, triggering significant rebalancing, trading, and volatility. M&A also surged in December as companies positioned for an economic rebound in 2021.

International equity markets remained muted for most of December as a surge in coronavirus cases and the emergence of a new mutated strain of the coronavirus in UK -- with increased transmission capacity -- threatened further lockdowns across the region and raised doubts regarding the efficacy of existing vaccines against the new strain. However, markets rebounded as the European Union unanimously passed their 1.8-trillion-euro stimulus package after months of negotiation and finally concluded a Brexit deal, for better or worse. The advent of a mass vaccination campaign across the continent further boosted markets.

Unlike the rest of the developed markets, Japan continues to witness sustained gains as they have been comparatively less affected by the second wave of the pandemic and the economy is expected to receive a major boost from hosting the Olympics in 2021.

Emerging markets, apart from China, had a good month. The global economy is starting to rebound with the availability of vaccines, driving up demand for commodities such as oil and industrial metals and, subsequently, improving the outlook of various countries across Latin America, Middle East, Africa, and Europe which are heavily dependent on the mining and production of the above-mentioned commodities.

Chinese equity markets, on the other hand, have been on a downward trend for the past month due to a rise in corporate defaults from state-owned companies and government scrutiny of the fintech sector. Earlier in the month, the Chinese government suspended Ant Financials’ dual-IPO claiming regulatory violations, and later fined both Alibaba and Tencent for violating anti-monopoly laws. This increased investor concerns and caused their respective share prices to drop, thereby pulling down the whole market.

Over the past month, the yield curve steepened as the Federal Reserve continued to keep short-term interest rates close to zero while a combination of vaccine availability and passing of the second stimulus bill pushed up long- term yields. Unemployment claims continued to hover around the 800,000 mark in December, leading to a temporary widening of Corporate Spreads. These eventually tightened with the passage of the new stimulus bill and caused High-Yield Spreads to drop to a yearly low of 3.59 percent.

Commodity prices have surged in December, albeit for different reasons. Prices of crude oil and copper have risen considerably as the dollar continues to weaken and the availability of vaccines continues to drive a global economic recovery that has boosted expectations of demand. Gold prices on the other hand have increased to $1,883.663/ounce in response to near-term concerns of rising unemployment claims and limited vaccine availability, which continues to lag the massive increase in coronavirus cases.

Going Forward: Road to Recovery

The dramatic headlines of the past week have barely registered with securities markets, generally. Equities have risen, high-yield bond spreads have fallen while ten-year yields have risen and the Treasury Yield Curve has steepened, which all suggest one message: the road to economic recovery is finally here.

And, in looking past the current pandemic to the eventual reopening of the economy, markets have steadfastly remained overvalued as earnings have been crippled by the uneven slowdown in the economy, yet price impacts remained muted or even rose across favored sectors.

We shouldn’t forget the enabling power the Fed has had on all markets, including credit and the Treasury yield curve in keeping markets frothy. Let’s also keep in mind the impact of broad fiscal stimulus, which dispersed money hastily across markets with the hope of bridging the gap in economic activity caused by the pandemic.

Finally, we can’t forget that the U.S. administration will change and, as such, changes in domestic, foreign, and trade policy may also create investment opportunities.

As we consider the roadmap for 2021, we must consider each of these potential impacts individually.

Monetary and Fiscal Policy

Monetary and fiscal stimulus played perhaps the most significant role in keeping markets afloat during the most significant pandemic in recent history. Over 90 million people have contracted COVID so far and nearly 50 million have recovered. A little over 38 million are currently ill and almost 2 million people have died. What started in China, migrated to Italy, then to the UK, and finally to the U.S., has gone through various fits and starts with countries and states acting independently to deal with this.

China and much of Asia locked down the fastest, instituted widespread testing and contact-tracing and have managed the pandemic with limited damage. Europe was next to act: first with stimulus and then with lockdowns, but the measures were less coordinated. The UK acted with stimulus and lockdowns and little enforcement. And the U.S. acted with little direct fiscal stimulus and unsystematic lockdowns across states with little enforcement. The less coordinated the response, the more devastating on a per capita basis was the effect of COVID. The U.S. now has the largest absolute caseload, and the U.S., UK, and parts of Europe and Eastern Europe are among the worst hit on a per capita basis. The U.S. stands out even more when measured according to national healthcare budget and size.

To manage the economic effects of the pandemic, we saw two policy tools executed. First, loose monetary policy with a revised framework for determining when to tighten policy. This would allow policy to remain loose until persistent inflation could be measured over time rather than at a point in time. This will ensure that as long as excess money does not find its way into inflation, that excess money will find its way into asset prices and fuel bubbles. As evidence, issuance in high-grade and high-yield credit are at decade highs while credit spreads are at decade lows. It feels that we are once again picking up pennies in front of a steamroller, enticed to take more and more risk for less and less return.

Next, fiscal stimulus in the form of sector-specific aid, corporate loans, paycheck protection, unemployment support, eviction moratoriums and direct checks to American taxpayers have had certain effects. Some of the stimulus has hit its mark and helped average workers impacted by the pandemic to continue to remain in their homes and put food on the table. The next chunk of this money has simply been saved by those who have been less affected but are concerned that they might be affected in the future.

These enabling elements to market frothiness are, in our opinion, likely to remain in effect in 2021 with monetary stimulus and ultra-low rates a fixture for the year and fiscal stimulus a feature of the first half of the year. So, while it is easy to call the markets overvalued, we must remember that the markets can remain irrational longer than we can remain solvent betting against them. But, if it is unsustainable, it will eventually stop. Participation with protection will be the key to navigating these markets.

Shifting Political Winds

Joseph R. Biden Jr. will take the oath of office of the U.S. Presidency on January 20th. With a slim majority in the House and a razor thin majority in the Senate, he will set out to enact an aggressive agenda that ranges from climate change to socially driven business investment to broad infrastructure investment to tax overhaul. Any one of these agendas could take years, but for now, he only has two years before mid-term elections to enact these changes without excessive political friction. While each set of policies are likely to create opportunities that are worth tracking, we would look toward the administration’s stance on trade, foreign policy, and technology to define large market impacts.

President Trump, whose Twitter and Facebook accounts have recently been suspended citing violation of company user policies, is calling for a revocation of Section 230 of the Communications Decency Act, which places the liability of material posted to the person posting it, not the platform hosting it. A revocation of this act would have significant consequences to the cost structure and busines models for big tech, which are the single largest component of equity market indices.

The question of internet regulation has and will continue to be an evolving risk to technology companies which should be monitored. As Republicans may be going after them for a bias towards silencing conservative voices, Democrats also feel resentment over their role in the spread of misinformation during the 2016 elections and privacy. To anger everyone on Capitol Hill may not be a great strategy for long-term survival, and this could invite market-wide U.S. equity risk.

Perhaps the bigger shift in political winds will come in foreign and trade policy. While President Trump took an isolationist approach to foreign policy, President-elect Biden has clearly stated his intention to reengage with allies, but also intends to keep focused on rebuilding U.S. supply chains. While this could invite some additional support for international markets, it is unclear how this will work out in terms of market winners and losers.

COVID Challenges

Global governments are charged with mass vaccinating significant swaths of their populations. This represents a significant challenge fraught with logistical complexities and potential for execution error. In the meantime, we will enter a confusing period during which some will be vaccinated, and others will not.

We suspect people will let their guards down, ushering in a third smaller wave of the pandemic. However, no matter how small, fear will resurface along with concerns about the efficacy of the vaccines and potentially more self-imposed lockdowns. Make no mistake: this pandemic is not over until mass vaccination has been achieved and caseloads fall precipitously. That could take months, if not all year.

For this terrible reason, we anticipate continued monetary and fiscal support; however, the valuation landscape will certainly change.

Up to now, the valuation landscape has not changed much. Segments of the market that were overvalued going into the pandemic remain overvalued. Segments of the market that were cheap remain cheap. There was little change in that valuation landscape, except optimism around digital learning and remote working, to significantly boost or alter outlooks. However, now the risk landscape is about to change politically before the economic engine is up and running. This could give rise to a challenging pricing environment and one that could be fraught with excessive volatility. Though we anticipate that the markets will once again re-open and valuations will be restored as normalcy returns to earnings growth, it is likely to be a bumpy ride.

Net View

We remain defensive through the transition.

Within equity, we see further opportunity in value while maintaining a healthy recovery portfolio with growth exposure.

Within value we remain interested in names that may benefit from any economic disruption we may feel from the current second wave.

We remain neutral on international equity and fixed income.