This month we focus the impact of policy on inflation expectations.

The Reopening: Summary

- As the economy reopens, we are seeing cash find its way out of savings accounts and back into the economy: that marginal savings withdrawal seems to be coming out of the most speculative segment of the market, hurting the most speculative of assets including crypto assets, SPAC’s and IPO’s.

- While growth investors have made brief stands, market oscillations favor value: perhaps the most important market nuance is that growth-at-a-reasonable price (GARP) investing, which has been the clear winner since the beginning of the year that is now solidly lagging value, suggesting that investors are increasingly concerned about price.

- As monetary policy remains accommodative and a fiscal policy looks to continue to deluge the economy, the question of inflation remains at the top of minds for investors: supply shortages and labor frictions are feeding the concerns, but the consensus believes these effects are transitory in nature.

Market Review: Inflation!

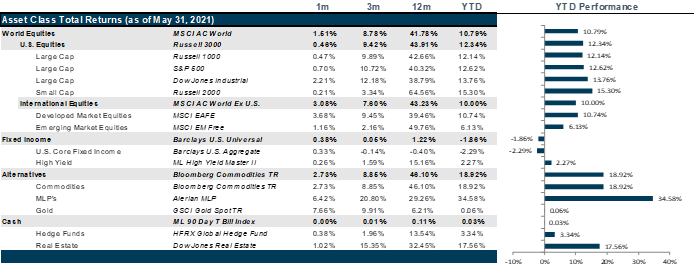

The U.S. has had a stellar vaccination drive with 41.5% of the population fully vaccinated against the COVID-19. In response, states have begun to lift restrictions, businesses have started to reopen, and unemployment claims fell to the 400,000 level towards the end of May. Reflecting the rise in demand, the Consumer Price Index rose by 0.8% in April, beating analyst expectations by 0.6% and reigniting the debate on the speed of inflation growth driven by the massive government spending on stimulus payments. This led to a selloff in U.S. equities which was stemmed by explanations such as bottlenecks in the supply chain helped to blunt the effects of a disappointingly flat April retail sales report. And, although the Fed agrees that inflation is likely transitory, markets seem to be discounting future cash flows at high enough expected interest rates to continue to take the wind out of the sails of advancing sectors like Technology and Consumer Discretionary. In addition, the global minimum tax rate proposed by Treasury Secretary Janet Yellen could further eat into the revenues of large technology companies such as Apple, Facebook, Google, and Amazon, who are already facing disputes domestically and internationally over consumer data privacy as well as monopolistic practices.

International markets have had a varied performance over the past month andEuropean equities received a boost as U.S. investors rushed to diversity their exposure to more cheaply priced re-opening trades. As the pace of vaccinations continues to pick up, so do the chances for an increase in tourism by summer for vaccinated tourists. As a result, economists have revised up GDP estimates for the EU for 2021 and 2022 to 4.3% and 4.4% respectively. On the other hand, Japan continues to suffer from a slower vaccine rollout and rising infection rates which have resulted in extended lockdowns in certain prefectures including Tokyo, raising uncertainty for the Olympic Games which are due to start in late July.

Emerging markets remained flat in April, lagging other global indexes owing to the spike in new Covid-19 cases across Brazil and India which resulted from a set of new mutations in the virus and a slow vaccine rollout. As developed economies continue to reopen, demand continues to rise. Alongside this rise in demand is a shortage of supply pushing up commodity prices, which would normally be a windfall for commodity exporters, but given the shutdowns and labor shortages, has failed to result in the usual GDP pop. Meanwhile, commodity importers are hit with a double whammy. On the other hand, in China a combination of a government clampdown on the booming technology sector and focus on deleveraging local debt has led to increased uncertainty and kept market returns flat, whileEM equity continues to be a challenging space.

Falling jobless claims driven by a vaccination induced economic recovery pushed up treasury yields towards the middle of May, but as long-term inflation concerns persist in the markets, investors are reducing the duration of their portfolios as well as loading up on high yield corporate debt. Credit risk concerns in the market remain low as the recovery momentum continues to gain steam and the Federal Reserve intervention in the bond markets during the peak of the pandemic set the tone for the future wherein investors believe that in case of massive defaults the central bank will bail them out, allowing even companies with high default risk to continue borrowing at low rates.

WTI Crude Oil prices closed the month at $68.44 per barrel. Demand has risen despite the loss of demand in India with red hot demand in the U.S. and China more than picking up the slack. Although OPEC is adding supply to the markets, instability in the Middle East combined with sustainability efforts against oil companies, including a court ruling against Royal Dutch Shell, a proxy battle at Exxon that won three board seats and a proxy battle at Chevron to call for further cuts in Scope three emissions that will effectively stifle oil production and supply and support higher oil prices. Scarcity of goods and excess money supply in the markets has led to commodity prices soaring, leading to inflation concerns and gold prices surging in May to the levels of $1900/ounce. In addition, grain prices have continued to surge as the global vaccine inequality has greatly affected lower income countries that are still struggling to exit the crisis,exacerbating the advent of further virus mutations. The United Nations Food and Agriculture World Price Index revealed that food costs have risen continuously over the past twelve months and further surprises are expected as adverse weather conditions such as droughts threaten crops in Brazil, and the uneven global economic recovery to deliver a demand shock that further drives up prices. In the cryptocurrency space, there has been a pullback in prices as both China and Iran banned crypto mining operations and Elon Musk raised concerns regarding the burgeoning non-renewable energy costs of mining crypto coins.

Going Forward: The Reopening

The post-pandemic boom is certainly booming. It was like shooting fish in a barrel for economists forecasting the boom. John Kenneth Galbraith once famously quipped, “the only function of economic forecasting is to make astrology look respectable.” However, as revisions went up in countries like the U.S. and China, surprises, unsurprisingly, fell toward zero in the U.S. and are now negative in China. Meanwhile, the more pessimistic outlooks for Europe and Japan have been met with huge positive surprises. So, the upshot is fairly straight forward: the recovery is here in the developed world. What is more interesting is that EM’s, where growth expectations still somewhat dire in the absence of vaccination doses and still struggling under COVID related public health and economic disruption, economic surprises remain positive even in countries where absolute growth is still quite negative. In fact, most EM countries, for example China and Taiwan are still facing negative growth, but not as negative as expected while positive spillover effects are still reaching the worst hit countries. Though clearly a multi-speed recovery, the effects look very efficacious on conditions that would normally favor growth. However, these markets are anything but normal.

Speculative Sell-Off

At the beginning of the pandemic as health restrictions crimped economic activity, savings rose dramatically. With the vaccination push in the U.S. and the corresponding fall in COVID cases, the in savings is equally meteoric. The uptake in the markets, however, has been two-fold. Partly, we have seen pent up demand unleashed by U.S. consumers looking to return to restaurants, replace their well-worn yoga pants with office appropriate garb and generally spend their savings on travel and other forms of entertainment as the summer approaches. The resulting loss in personal savings seems to also coincides with the sell-off in the most speculative assets. While causality is certainly far from established between these two events, it is worth noting that both seem to have momentum and are worth watching.

The Growth Value Shuffle

The remainder of the spending boom fueling the U.S. boom has been on the investment side, where companies have been dealing with preparations for a return to work along with more and more plans for a hybrid approach. We have also seen big investments into cyber security and business continuity as the digital world continues to become a more dangerous place. These are traditionally growthier companies that benefit from such spending, but interestingly, while growth as a group have had moments, value has continued to outperform, suggesting that many of these companies benefitting from this spending are already priced for the growth. Moreover, investors seem to remain wary of the debt fueled growth, remembering a credit fueled crisis from not so long ago that reminded us all that debt is a liability, not an asset, and must eventually be repaid by future growth. Though normally far too rational for the animal spirits of the market, the great financial crisis seems to be alive and well in market memory. Or at least, alive enough to make price a central concern for a little while longer.

Transitory or Structural, That is the Question

The big question hanging over the markets is the nature of the inflation arising out of the many disruptions in both the supply chain as well as in labor markets. Will these inflationary factors become ingrained into the structure of the economy? It has been so long since inflation was any real concern in developed markets, economies and populations mired in demographic challenges and the deflation that comes with technological innovation and productivity boosts. So, should we be concerned? Probably not. First, the economic disruption that occurred has created base effects that amount to some serious distortions. Harvard professor Robert Cavallo was quoted in the Financial Times with some compelling arguments as to why inflation during the pandemic was likely understated as well as why the inflation readings after the pandemic are likely overstated. The same can be said of European inflation. Moreover, the continued strain in supply chains and reluctance of some workers to return to work for a variety of reasons including personal health safety and childcare issues are certainly very real, but temporary contributors. While there is some evidence of wage inflation at the lowest wage levels, the general consensus remains solidly in the “transitory” camp.

Net View

We continue to overweight small cap over large cap in the U.S. and continue to overweight value and GARP versus growth in the great quality rotation and continue to increase our exposure to international equity over U.S..