The outlook for economic strength is overtaking concern over inflation and higher interest rates, but we continue to urge caution.

Reality Bites: Summary

- Downside risks to the growth outlook are a concern: with savings rates below long-term rates and interest rates at 23-year highs, it is unlikely that consumers can continue to spend at the same pace.

- Commercial debt driven banking risks have been minimized: although the Fed has demonstrated an unwillingness to let banks fail, that does not preclude market volatility that could easily arise if loan default activity starts to stress bank balance sheets.

- Inflation continues to rear its ugly head: sources of inflation range from cyclical to secular to potentially extreme but, taken together, continue to put upward pressure on inflation and interest rates.

Market Review: High Valuations Cut Down

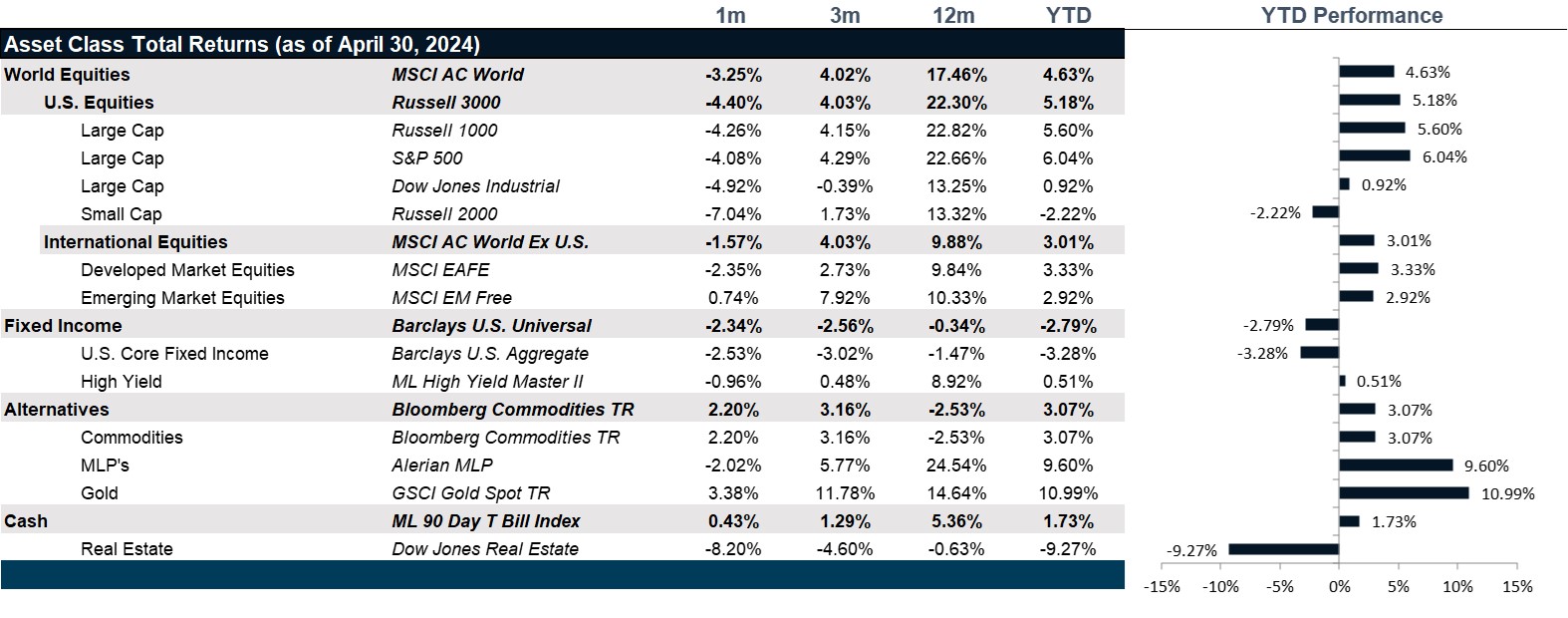

Economic surprises for growth indicators disappointed all month while inflation surprises trended up. All else equal, the Fed has expressed a preference toward abolishing inflation, and therefore weakness in the economy is not considered a mitigating factor. Over the course of the month, expectations for Fed cuts moved dramatically from three expected cuts by year end to only one. What began as a defensive rally played out like a repricing of forward price-to-earnings multiples back to the 20.7x ranges. Though this is on the low range for post-pandemic equity markets, it is still on the higher end of the range if interest rates stay higher for longer. That said, corporate operating margins continue to pick up and expectations for both earnings and sales are up and to the right for U.S. equities. The S&P 500 lost 4.1% for the month while the S&P 600 lost 5.6%. Style did not matter this month as growth stocks lost 3.9% and value stocks lost 4.3%. Valuation mattered more and defensive stocks had become overvalued in the short term.

Meanwhile, international equities followed the same pattern with higher valued pockets of equities underperforming lower valued equities. Europe outperformed Japan, losing only 1.83% in US dollar terms versus 4.45% for Japan in US dollar terms. In addition, international developed markets lost only 2.36% for the month, having largely been priced for stagnation in growth and therefore had less to be marked down in the new monetary reality. Meanwhile, the cheapest and arguably riskiest segment of the international equity markets, China, rallied with the kind of FOMO (fear of missing out) that feels unsustainable. However, the result was a significant outperformance for emerging market equities.

The bond markets participated in the April bloodbath as the yield curve also repriced for a higher Fed Funds rate. That said, the effective Fed Funds expected rate is 5% while the long end did not quite make up that gap for a flat expected curve. The 30-year Treasury did move up 41 bps over the course of the month, but the 2-year rose 38 bps to 5%, still pricing in a mild recession. Surprisingly, high-yield lost only 94 bps versus the 2.54% loss in high-grade credit and the 2.53% loss in the Aggregate Bond Index on the whole. Even more surprising was that both high-grade and high-yield spreads ground lower, not adjusting for higher underlying yields. Both Moody’s and S&P issued a fair number of upgrades to credit issues, suggesting that the outlook for defaults is falling, which is good for credit holders.

In real assets, the trend of high valuations leading to more significant repricing also held with industrials marking the worst performance in the REIT space, losing just over 19%. Meanwhile, the much-maligned office sector lost 6.78% and the most consumer sensitive retail sector lost only 3% this month. Meanwhile, commodities posted strong results, with precious metals and gold performing on the back of continued inflation fears and industrial metals surged this month as manufacturing in the U.S. and China are fueling demand. As canaries in the coal mine go, this suggests that the economy is more resilient than expected and that inflation is unlikely to go away. This also supports the notion that the Fed may not have to cut rates more than once, if at all, and if that is the case, then the latest repricing in the economy is likely to be the start of the next trend.

Going Forward: Reality Bites

It was the best of times, it was the worst of times. Expectations for the economy continue to be revised up to a healthy 2.4% growth expectation for 2024, up from a technical recession expectation of 0.6% at the nadir of expectations last year. Meanwhile, expectations for 2025 growth continue to be revised down to 1.7%, which is hardly a recession. Moreover, earnings continue to beat expectations and expectations still suggest a growth trend despite cautious earnings guidance. In addition, credit quality is rebounding with credit upgrades outpacing credit downgrades for investment-grade credits. However, the economy seems weak at the margins and expectations for growth are underperforming actual growth data. Yet, it is not weak enough to move the Fed toward cutting rates. In the meantime, actual inflation is coming in hotter than expectations. Taken together, the reality that the interest rates are not restrictive enough to warrant a rate cut yet and that inflation may not yet be addressed leaves the very real possibility that the Fed may not cut interest rates at all this year. The Fed Funds Futures curve has adjusted to price in one single rate cut in December.

The Case for Consumer Weakness

With growth expectations at 2.4% in 2024 and 1.7% in 2025, the economic picture looks reasonably healthy. However, the consumer economy has a few important moving parts. First, we have labor cohort dynamics that show that labor participation for the 55+ segment of the labor market remains well below long term averages while the 25-54 segment of the labor market is well above long term averages. So, despite rising unemployment levels, wage growth has remained higher than average and hiring at companies is still difficult, reflecting worker shortages. While this is good for the working population because their wealth has been growing faster than inflation and that has fueled spending, we also note a worrying trend in rising credit card debt levels, a rising trend in both 30-day and 90-day credit card payment delinquencies and auto payment delinquencies. Hidden stress in the economy can and does still have the potential to disrupt an otherwise healthy economy.

The Case for Real Estate and Banking Weakness

Meanwhile, with rates remaining high and the long end of the yield curve rising up to that reality, the potential for distress in the commercial real estate sector remains real as office buildings struggle and the community and regional banks remain heavily exposed to this segment of the market. That said, the Fed is clearly unwilling to let banks fail and the S&P Regional Bank index continues to move sideways despite the risks. That said, there is still a case for market turmoil in the face of loan defaults.

The Many Sources of Inflation

Despite the potential for economic weakness that could push the Fed toward a rate cut, the reality is the sources of inflation remain plentiful. The shortage of working age labor market participants is a positive source of inflation, but one which will make it challenging for the Fed to see rate cuts as necessary. Furthermore, geopolitical tension keeps pressure on commodity supplies, particularly in the face of a Chinese recovery which is already impacting the U.S., European and Japanese inflation. Finally, geopolitical tension will keep the march of deglobalization going which will push up inflation as the U.S. continues to onshore and nearshore. This is likely to result in a higher inflation for longer and a Fed unwilling to cut rates.

Net View

We remain neutral in our portfolio view while our expectation for continued volatility supports hedging equity risk assets.