This month, we focus on balancing market caution with the expected economic recovery.

Quality Matters: Summary

- Optimism for a post-pandemic boom favors the US, Japan and China over Europe and the remainder of EM: that said, valuations favor Japan as US valuations have priced in the recovery, the markets now favor value over growth, and Chinese markets peaked in 2020.

- Debt fueled demand, however, has proven to be a double-edged sword: while some see a goldilocks-type roaring ‘20s coming, bond yields are reflecting a combination of short-term inflation fears and long-term debt sustainability fears, triggering a focus on valuation in the equity markets.

- Balancing growth and value: though many characterize the recent rotation as simply value over growth, we see it as growth at a reasonable price. Because of where we are in the cycle, quality matters.

Market Review: Supply Chain Strain

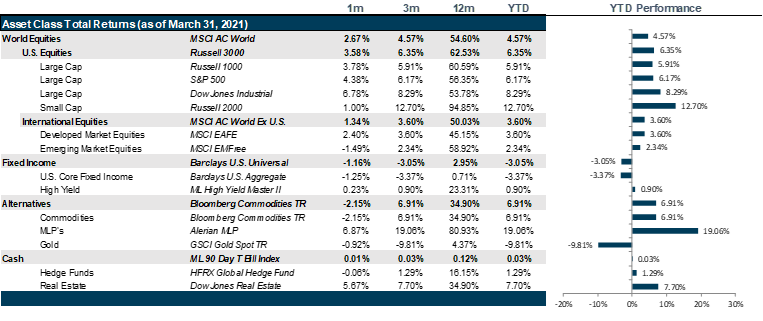

Markets in March were influenced by supply chain disruptions, geopolitical events, inflation expectations and liquidity risks.

Markets see-sawed in March as the Federal Reserve signaled for a slow exit to monetary accommodation while bond markets fretted over mounting inflation concerns and debt sustainability concerns. Kicking off the debt concerns, distribution of the $1.9 trillion stimulus began in the second week of the month while the vaccination drive under President Joe Biden accelerated dramatically, fueling optimism for a post-pandemic boom on one hand and mounting inflation pressures on the other. The economy added 379,000 jobs in February while the January results were revised upwards from 49,000 to 166,000. The resulting selloff in treasuries caused bond yields to rise and led to an exodus from the growth technology sector to cyclical sectors such as Financials, Utilities and Consumer Staples. Exacerbating inflationary concerns, a ship the size of the Statue of Liberty got stuck in the Suez Canal, blocking the shipping lane for two weeks causing supply chain strain and shortages. The alternative longer route passing around Somalia where piracy concerns remain prominent caused cargo prices and related sectors such as energy to soar. The ongoing global semiconductor shortage is driving outflows from the automotive sector, many of whom had to idle some of their plants in wait for components, creating some uncertainty around exuberant earnings expectations. Towards the last week of the month, Archegos Capital, a family office, failed to meet their margin requirements, forcing mass liquidations by their brokers. Nomura and Credit Suisse were late in selling off their portion of the assets, forcing them to write-down the losses on their books and suffering a $9 billion collective wipeout in the equity markets; however, the systematic impact turned out to be limited.

International equities have on average edged higher over the past month, and the reflation trade on the back of the economic rebound in the US has had minimal impact on markets in Europe. Another set of potential lockdowns and investigations into blood-clots arising from the AstraZeneca vaccine bogged down the already slow vaccination rollout in the eurozone along with increasing COVID vaccine hesitancy. While the block trade selloff from the collapse of Archegos Capital impacted the European and Japanese markets, ultimately the markets were driven higher by the individual sectors benefitting from supply shortages as a result of the Suez Canal blockage. Japanese equity markets edged higher towards the last week of the month as the au Jibun Bank Japan Manufacturing PMI index was revised higher than preliminary estimates and the vaccination drive set to begin in April is expected to provide a boost to domestic demand.

Emerging markets lagged other global indexes in March as Chinese market weakness combined with forced rate hikes in Russia, Turkey, and Brazil to combat inflation. Expectation of a reset in US-China ties under President Biden fell apart as the first high level meeting in Alaska ended unceremoniously, complicating an already shaky relationship. To add fuel to the fire, the SEC passed new rules requiring foreign companies listed on US exchanges to comply with US auditing standards and submit documents to establish their independence of foreign government entities. Domestically, the Chinese government’s crackdown on financial technology and e-commerce sectors over violations of anti-monopoly laws as well as the central bank’s focus on tapering stimulus and deleveraging the economy has resulted in investor profit-taking. The forced liquidation of Archegos Capital aggravated the already shaky markets as the fund owned several Chinese tech stocks like Tencent and Baidu.

WTI Crude Oil prices held above the levels of $60 per barrel, while copper and silver prices continued to fall despite the new green infrastructure plan unveiled by the Biden administration, as the potential increase in demand has already been priced into the markets. News ranging from lockdowns in Europe to US economic rebound and extreme side-effects from vaccines has allowed Gold prices to maintain their $1700/ounce levels, however further pullback is expected as the global economy continues to recover. In the cryptocurrency space, Bitcoin prices surged beyond $60,000 by the second week of March and continues to test those levels as banks and other financial institutions signal greater adoption. A large part of the surge in prices is driven by the extraordinarily large stimulus injected directly into the economy. However, the IRS requiring people to disclose their ownership of crypto-assets, and the development of digital currencies by major central banks around the globe, along with greater focus on the greenhouse emissions from crypto-mining operations could greatly depreciate the value of popular crypto-currencies.

Going Forward: Quality Matters

Since the start of the pandemic, the markets were quick to recover and quick to assume that this would be temporary. And even when confronted with evidence to the contrary, the markets continued to look past the present and toward the future where everything would not only be ok but could be better than it was before. Then came the realization that the debt load was starting to look excessive, and the markets began to re-price. While the market participants are still holding on to the notion that growth is coming they are now more sensitive to the price they are ultimately paying for that future growth. The key risks that remain are whether the resulting growth comes quickly enough, whether that growth is damaged by inflation or whether the growth expectations are simply not attainable.

Post-Pandemic Boom

As the vaccine roll out has finally picked up steam, optimism for an eventual re-opening of key economies by the end of summer and a return to school for children in the fall continues to build and with that, economic optimism for a post-pandemic boom. Though countries with smaller populations lead the US in terms of percentage of vaccinated population (Gibraltar, Israel, Seychelles, Cayman Islands, Bermuda, Monaco, Chile, Bahrain), it is also important to remember that the total percentage of people vaccinated globally remains low. And this has come to matter meaningfully in commodities prices and in supply chains where pent-up demand meets mine and manufacturing closures, shortages of labor or other logistical issues. As these shortages and disruptions have fueled short term inflation concerns, it raises the concern that if the vaccine roll out does not pick up steam globally, these issues could cause significantly more inflation strain which could eat into that pent-up demand we are banking on. Moreover, if vaccine effectiveness against new variants falls short of expectations or the immunity period requires another major round of boosters, the bridge to that boom may be longer than is priced in. However, the upside scenario is that boom is stronger than anticipated, though estimates are skewing strongly to the upside as it is, so we see this upside risk to be lower than the downside risks.

Debt Sustainability

Much of the optimism has to do with significant debt financed fiscal spending. Massive programs to distribute money directly to Americans, boost unemployment, increase access to long-term, cheap Small Business Association lending programs and Paycheck Protection Programs to keep demand from plummeting during the pandemic led to a rise in household saving. That, combined with even larger stimulus packages targeting major infrastructure spending are almost certainly going to produce demand. However, debt markets have homed in a key metric: debt to GDP, the gold standard for measuring debt sustainability. In short, when your debt stock grows faster than your income is or can reasonably be expected to grow, bond markets get nervous. That nervousness has translated into a rise in yields that, while taking a breather at month end, looks to still have legs. A combination of short-term inflation expectations fueled by demand which will likely exceed the capacity of the markets, particularly with the supply chain disruptions we have been and will likely continue to experience; and long-term debt sustainability questions have conspired to challenge the optimism of the equity markets. As bond yields rise, stock markets with very low dividend yields cannot compete. Market sentiment has turned decidedly negative across all markets including stock, bond and alternatives markets, with the lowest risk assets garnering the best returns and the highest risk assets getting penalized. This is likely to persist until GDP growth resumes in earnest and debt to GDP falls just by virtue of GDP rising.

Growth vs Value

While many market participants characterize the last six months as a rotation into value, we have noted that quality matters. This is even more important considering where we are in the cycle. As we enter a strong post-pandemic boom, participation in that expected growth will matter. So, investors are not just looking for cheap investments, but rather cheaper ways to access growth, a strategy referred to as “growth at a reasonable price” or GARP. GARP as a strategy has handily outperformed the broad stock market for the past six months and we anticipate that it will continue to do so as long as bond yields rise and a recovery is still priced in. That said, if the outlook for the recovery faulters either because of the speed of the vaccine roll out or vaccine effectiveness, markets could experience a full scale sell off where cash will be king.

Net View

We continue to overweight small cap versus large cap in the great catch-up trade, continue to overweight value and GARP versus growth in the great quality rotation and continue to increase our exposure to international markets in a cautious and gradual manner, all of which have served us well.