This month, all eyes are on the election outcome and the path ahead. Given the best information we have to date, we walk you through next month, the rest of the year and beyond.

The Next Chapter: Summary

- Joseph R. Biden will become the next President of the United States: However, Congress is likely to remain split. This is a very risk friendly outcome.

- The Second Wave is underway: the Pandemic is looking to disrupt economic activity yet again and now the markets are going to be forced to reprice this as less temporary and more long-lasting in terms of earnings damage and business model impact.

- The transition looks messy: Just the process of finalizing this election may be a significant source of short-term volatility, but the bigger risk comes from the unwillingness of a lame duck congress to agree on pandemic stimulus aid.

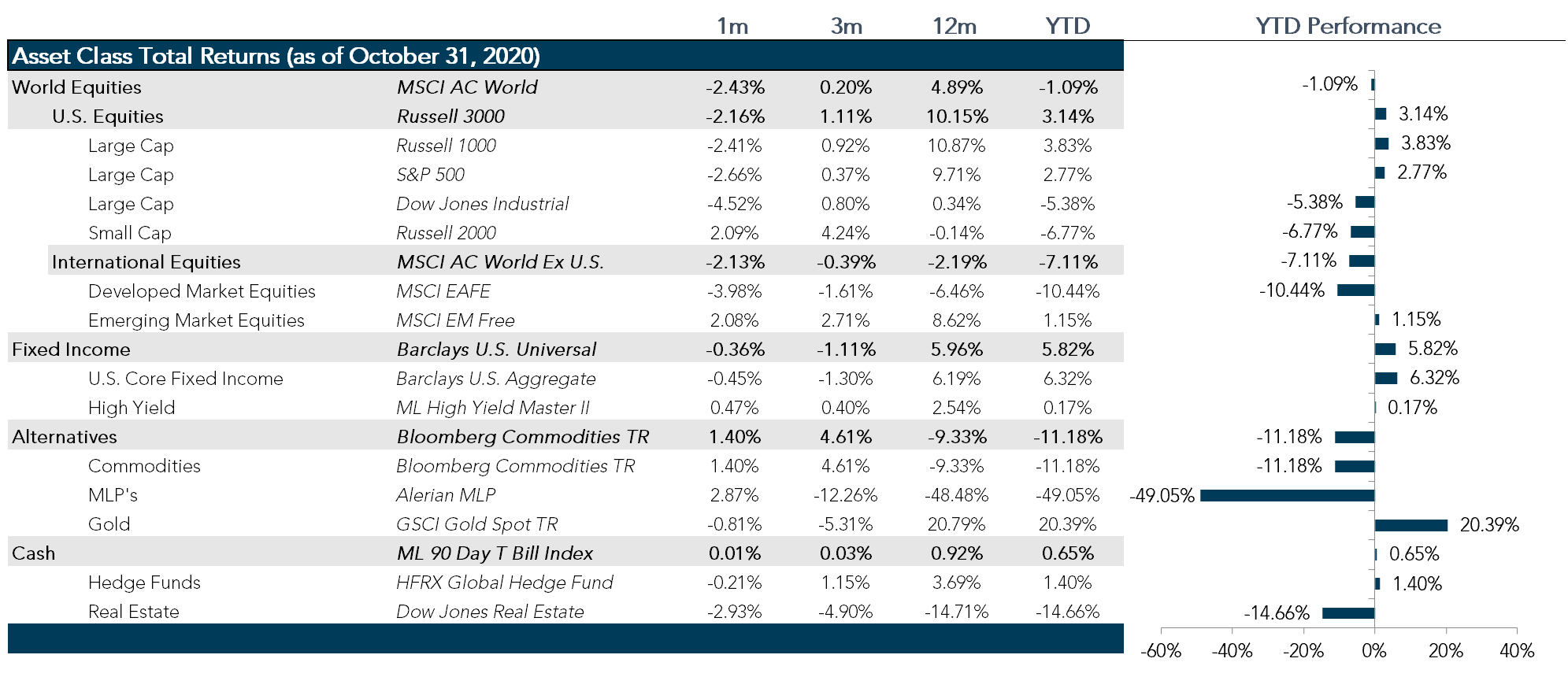

Market Review: The Calm Before the Storm

Markets in October focused on the upcoming U.S. presidential elections, the rise in COVID-19 cases in the U.S. and abroad and the sell-off across technology sector stocks as the outlook for the recovery dims.

The U.S. Equity Markets experienced elevated volatility in October. For the first half of October, despite President Trump contracting the coronavirus, markets moved upwards primarily driven by steady weekly unemployment figures and optimism regarding the passage of a second stimulus bill.

However, as stimulus hopes faded, not even a string of positive earnings surprises could keep markets from falling. Social media companies such as Facebook and Twitter led the fall as they reported a decline in number of active users and continued to face increased scrutiny both domestically and internationally. In addition, as autumn set in, the U.S. witnessed another wave of new infections and the total tally of active U.S. cases crossed the nine million threshold.

International equity markets experienced very bifurcated results with Europe taking the brunt of the negative performance for the month as the second wave of the pandemic led to announcements of partial lockdowns in major European cities like London and Paris. The delicate balancing act of preventing further spread and strain on health resources continues to work against the goal of restoring economic activity. Meanwhile, Japanese markets have benefitted from the selloff in U.S. and European markets as it emerged as a leading destination of investment for investors in search of value stocks as the country has managed to keep it’s COVID-19 deathrate per 1 million population among the lowest in the world.

Emerging markets were on an upward trend in October led by China. China’s factory activity has continued to increase since May and with the government having effectively controlled the spread of the coronavirus since the first outbreak. International investors have continued to increase their investments in Chinese firms in search of high returns, pushing the stock market value beyond $10 trillion for the first time since 2015. Another factor propelling China’s markets upward was the minor lead Joe Biden held in polls. Under President Trump’s administration, ties between the U.S. and China have worsened, while it is expected that Joe Biden ascending to presidency will help reduce the friction between the two countries.

Over the past month, the yield of the 10-year U.S. Treasury index experienced a roller coaster ride. Early in the month, yields remained consistent with steady labor data and the hope of a stimulus bill. An initial surge in volatility drove yields down midway through the month as Treasury Secretary Steven Mnuchin expressed doubt of a pre-election stimulus bill. And yet, the hope in the markets persisted, driving yields back up only to be dashed again on October 23. Though by month end, Treasury yields recovered their losses despite the election tension and volatility mounting in the pre-election run-up.

Commodities were mixed in October with West Texas Intermediate Crude oil suffering a hit in price down to $35.79 per barrel as COVID-19 forced European cities to impose tighter restrictions. Though other parts of commodities suffered a downturn toward the end of the month, industrial metals managed to keep positive returns for the month. Meanwhile, precious metals and gold, in particular, which have benefited greatly from initial pandemic uncertainty, demonstrated lackluster, sideways performance as we headed into the election, suggesting less market concern regarding the U.S. election outcomes than perhaps suggested by the media.

Going Forward: The Next Chapter

As we write this, the counting of the votes continues in Georgia and North Carolina, though Biden has secured an electoral victory. The first and most important observation is the daily tick movements of risk markets, starting with the equity market going into and since election day.

The pattern is a classic “V” shaped worry pattern. The VIX volatility index confirms that pattern with an opposing hump as volatility rose to peak out at a hefty 42% before calming back down to 27%, which is still elevated, but not alarming. Though while investment grade debt spread risk followed the same U-shaped pattern rising to a peak of 68 bps over Treasuries, high yield debt spread risk traced the exact opposite pattern.

The fear trade seems to confirm the high yield pattern of risk concern. Ten-year treasuries went into the election elevated, but are starting to exhibit fear and compression, though this is more likely driven by daily COVID-19 cases exceeding 120,000. Similarly, gold has barely exhibited a pulse in the past month but has edged up toward $1950. Along with the finalization of the election, the electoral college election, and any transition, a pandemic second wave will also continue to exert risk pressures.

The U.S. Election

Joseph R. Biden has secured the required 270 electoral votes, though the journey toward the finalization of the vote count continues with the challenges that the Trump administration has promised.

The Senate looks very likely to remain solidly in GOP control, though two seats in Georgia will go to a run-off election in January. Though there are hopes on the DNC side to pull off a Doug Jones-like upset in January, the probabilities favor the two GOP candidates.

Market reaction throughout election week was reasonably supportive of the change in administration tempered by a split congress.

The Pandemic

Meanwhile, as the election count has dragged on, the U.S. has hit record after record for daily new cases. Europe and the UK face the same likelihood that more countries will be forced to impose pandemic related restrictions on social gatherings. The resulting drag on growth may be quite significant.

While in Europe, there are more aid facilities available to buffer the impact to the real economy, the U.S. has been unable to agree on how to move forward in the face of expiring programs. Worse yet, the emergence of the second wave has dashed many hopes that the pandemic would be a temporary disruption. Moreover, as the pandemic has dragged on, the notion that the world will forever be a digital experience is also being challenged as employees are tired of working from home and people naturally long to be social.

The resulting collision of those two realities means that stocks must reprice for deeper and possibly more permanent effects to earnings while technology cannot possibly meet the growth required to justify earnings. However, a well-timed stimulus package could mitigate that risk. However, the risk is starting to feel binary.

The Transition

The greatest risk is the transition between now and a new administration. The potential for continued mishandling of the pandemic, combined challenges for delivering vaccines by year end, and a lame duck Congress unwilling to agree on the terms of a stimulus package, lead us down a very choppy road. With the election now done and the potential for a change in the management of the pandemic, the reality is that any change may be too late to affect the current wave of infections. The risk of a significant repricing is somewhat tempered by the election outcome so far. However, that may be tested along the way and we see stimulus as the main driver of risk between now and January.

Net View

We remain defensive through the transition.

Within equity, we continue to look for opportunities in value while maintaining a healthy allocation to primary growth sectors like tech.

Within value we are particularly interested (once again) in names that may benefit from any economic disruption we may feel from the dreaded second wave. Though we are going to neutral on international equity, the same question is driving our search abroad: what companies will do well despite or because of the second COVID-19 wave. Within fixed income, we remain neutral.