Market Update

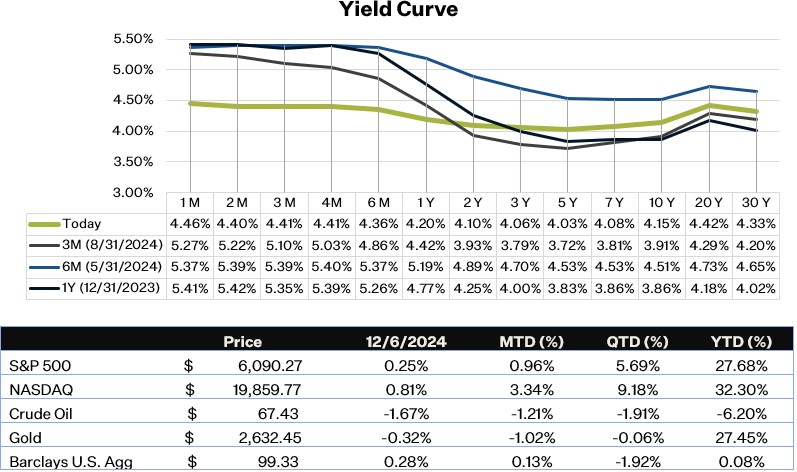

The S&P 500 hit a record high on Friday, buoyed by signs of a cooling labor market that indicated moderation rather than significant weakness. This fueled market expectations for a potential December rate cut instead of a pause, propelling equities higher. November's labor report showed an uptick in hiring momentum, while the unemployment rate edged up slightly from 4.1% to 4.2%, providing the Federal Reserve some flexibility to ease monetary policy. Looking ahead, all eyes are on Wednesday’s inflation report. A softer-than-expected reading would likely cement expectations for a rate cut. Meanwhile, the 10-year Treasury yield declined to 4.15%, reflecting the anticipation of a December rate cut.

U.S. Jobs Report

Nonfarm employment for November came in slightly above expectations, with the U.S. adding 227k jobs for the month. The rebound in job gains reflects the end of manufacturing strikes and the temporary negative impact from hurricanes reversing. Most of the job gains came from the healthcare and government sectors (continuing the trend we’ve been seeing for months) along with leisure and hospitality. Payroll growth was also revised slightly up for both September and October. The 3-month average of payroll growth is now at 173k, which isn’t that much lower than the first half of the year’s average of 207k. Average hourly earnings increased a robust 0.4%, which was above expectations, leaving the year-over-year (YoY) rate unchanged at 4%.

Looking at the household survey details, the unemployment rate ticked up from 4.1% to 4.2%. The increase though was partially due to new entrants and people reentering the workforce. However, a couple other details in the report were somewhat concerning. The number of permanent job losers reached a cycle-high at 1.89 million. Additionally, unemployed are staying unemployed for longer, with the average duration of unemployment increasing slightly in November to 10.5 weeks. If we add part-time and discouraged workers to the unemployment figure (also known as the U-6 rate), we see that 7.8% of people are either unemployed or underutilized. This is significantly higher than the year-ago level but has remained rangebound between 7.7% - 7.9% since July of this year. Overall, the details of the employment report show that the labor market is still ok. The market is still expecting the Fed to cut rates in December (85% probability), but we still have the inflation CPI report for November being released next week which will be a key factor in their decision as well.

Retail – Black Friday & Cyber Monday

Walmart, Amazon, and fast-growing e-commerce platforms Shein and Temu reported record-breaking sales on Black Friday and Cyber Monday, positioning them for a strong holiday season compared to struggling competitors like Target and Best Buy. Amazon led among major retailers, with Black Friday sales up 6% year-over-year, according to Facteus, which tracks U.S. spending data. Walmart followed with a 3% sales increase, while Target saw a modest uptick and Best Buy experienced declines. Low-cost Chinese competitors Temu and Shein delivered standout performances on Black Friday, achieving double-digit sales growth from a smaller base. Cyber Monday mirrored this trend, with Amazon, Walmart, Temu, and Shein posting gains, while Best Buy's sales fell year-over-year.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://www.bls.gov/news.release/empsit.t15.htm