Market Update

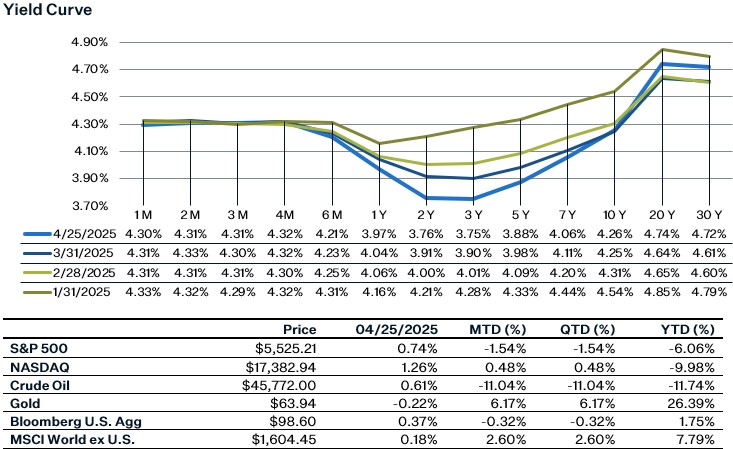

Last week temperatures cooled a bit on the policy front, as Trump hinted at a de-escalation of trade tensions with China and walked back his attacks on Fed Chair Powell. Trump commented early in the week that tariffs on China will come down substantially if the two sides reach an agreement (although not to zero). There seem to be conflicting statements about whether the two countries have even talked about negotiations, but it does seem that we are past peak tensions. The friendlier tone from Trump last week was welcomed by investors as the S&P 500 posted a weekly gain of 5.59% and the 10-year treasury yield declined to 4.25%. Despite the market's resilience, persistent challenges remain, including tariff uncertainty and economic growth concerns. Looking at the economic data, most of the hard data remains healthy but is backward looking, while survey-based data which has been weak and can be a leading indicator is not always reliable. We are starting to see some cracks in the hard data though- Los Angeles shipping volumes have declined which could cause inflation to reignite, and tourism to the U.S. has softened which could pressure consumer spending given the lower tourism. This week, attention will turn to key economic data, with advance estimates for Q1 GDP due Wednesday, where a slowdown is expected. On Friday, we will get an update on the labor market, with unemployment anticipated to remain unchanged. On the earnings front, major reports are scheduled from Microsoft, Meta, and Qualcomm on Wednesday, followed by Apple, Amazon, and Eli Lilly on Thursday.

Q1 2025 Earnings

As of 1Q 2025, 36% of S&P 500 companies have reported results, with a blended net profit margin of 12.4%, slightly below the prior quarter but above the year-ago level of 11.7%. Earnings growth for Q1 is estimated to be around 10.1%. However, forward-looking indicators are less encouraging given the current economic backdrop, with consensus expectations for earnings growth for Q2 being 6.4%. The full impact of new tariffs remains uncertain as negotiations continue to evolve. Corporate fundamentals appeared healthy before "Liberation Day," and the 4% downward revision to Q1 earnings likely sets the stage for a 4–5% positive EPS surprise, supported by resilient demand and strong reinvestment. Looking ahead, corporate guidance is expected to lower 2025 EPS estimates as companies adjust for trade headwinds. Investor focus is shifting from traditional earnings beats toward greater clarity around demand trends and pricing power that will determine how much companies can pass on tariff costs to consumers.

Manufacturing and Services Activity

The S&P Global flash PMI for April fell to 51.2 as services activity declined alongside a slight rise in manufacturing. The headline number at 51.2 is now a 16-month low and was below expectations, with the surprise being the drop in services. On the other hand, manufacturing output and orders picked up - which could be a result of continued front-loading ahead of anticipated tariffs. New orders in manufacturing are up significantly from their recent low last fall, however this strength will likely fade in the coming months. Price pressures have been the most notable impact of tariffs, with the input price index for manufacturing reaching its highest level in over two years. Within the services sectors, optimism has cooled as companies noted concerns over government policies and the subsequent economic uncertainty. Services firms are dealing with inflation issues as well, with prices rising to 7-month high. Additionally, overall business expectations for the year ahead dropped to one of the lowest levels since the pandemic. Until the policy environment stabilizes, it’s likely that business activity will remain subdued.

Sources:

https://www.pmi.spglobal.com/Public/Home/PressRelease/9ee36c52b8a649adada211c1842512be

https://www.oxfordeconomics.com/resource/inbound-travel-to-us-in-steep-decline/

https://www.cnbc.com/2025/04/22/busiest-us-ports-see-big-drop-in-chinese-freight-vessel-traffic.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4963687-0