Market Update

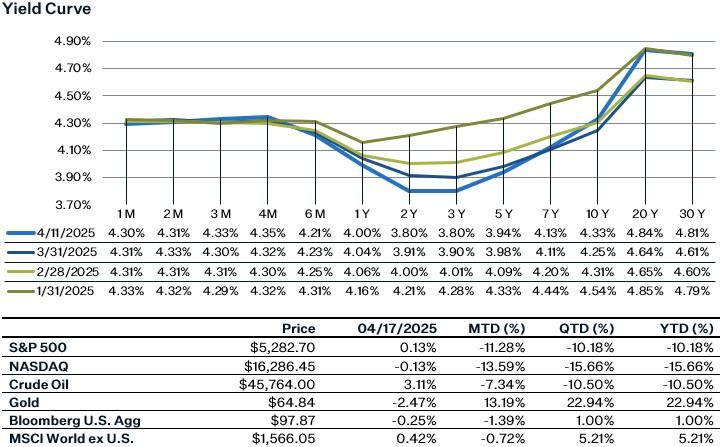

After two weeks of heightened volatility, where the S&P 500 swung more than 10% in a single day, markets stabilized last week. The S&P 500 finished up 0.52%, while the 10-year yield closed at 4.33%. Fed Chair Jerome Powell struck a more hawkish tone, effectively removing preemptive "Fed put" by emphasizing the central bank’s focus on inflation. The expectation still is that a rise in unemployment coupled with weak job growth would lead to cuts and put near-term inflationary concerns on the back burner.

Another source of uncertainty that the market may have to contend with is Powell’s status as the Fed Chair. On Thursday, President Trump criticized Powell’s stance and threatened to remove him, though the Fed’s independence makes such a move difficult. On the data front, the divergence between soft and hard data remains key. Retail sales (a hard data point) rose 1.4%, the strongest print in two years, driven largely by auto purchases ahead of expected tariff hikes. This week, all eyes turn to PMI surveys (soft data) for early signals of a potential slowdown in April. On the earnings front, Alphabet reports on Thursday, offering insights into AI-related investment.

March Retail Sales

Overall retail sales rose 1.4% month-over-month in March, above expectations. The strong rebound in retail sales was driven by a surge in auto sales and a more general front-loading of consumer spending ahead of tariffs. Motor vehicle and parts dealer sales increased 5.3% for the month, accounting for the majority of the March increase, as consumers rushed to get vehicles ahead of the new auto tariffs. Ex-auto sales were also up a healthy 0.5%, with categories such as building materials, electronics and appliances, and sporting goods seeing particular strength. Given that the strength from March most likely reflects tariff front-loading, we will probably see some weakness in the coming months.

US Jobless Claims

Initial unemployment claims by federal workers rose for a second straight week, reaching 629 for the week ending April 12—still near pre-layoff levels seen in January. Although federal employment has declined by 12,400 positions since March, the largest drop since the pandemic, weekly claims remain relatively subdued. This may be due to severance payments, pending legal decisions, or rehirings. Continuing claims rose to 7,025, up from 5,274 a year ago, suggesting more may seek benefits in the coming weeks. Virginia, California, and Texas saw the highest number of federal worker filings. Meanwhile, overall U.S. jobless claims fell to a two-month low, indicating broader labor market stability.

Europe - ECB

The European Central Bank (ECB) cut interest rates by 25 basis points to 2.25%, marking its seventh cut since June 2024, as escalating trade tensions threaten Europe's fragile recovery. The ECB removed the word “restrictive” from its policy stance and signaled openness to further easing amid rising downside risks to growth. President Lagarde emphasized “exceptional uncertainty” and warned that tariffs could dampen exports, investment, and consumption, while inflation continues to ease. The euro has unexpectedly strengthened, adding further deflationary pressure. Markets now expect another rate cut in June, with some forecasts suggesting a terminal rate of 1.5% by year-end. While inflation stands at 2.2%, weakening sentiment and falling energy prices may push it lower, prompting policymakers to remain flexible as they assess the broader impact of trade disruptions and increased fiscal spending across Europe.

Sources:

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4961194-0

https://www.census.gov/retail/sales.html