Market Update

It was another rollercoaster for markets last week, as news regarding the tariffs and their potential impact on the economy continued to cause huge levels of volatility. On Monday and Tuesday, the selloff continued as investors got ready for the reciprocal tariffs that were to take effect on Wednesday. Then on Wednesday, we saw a complete reversal as Trump announced a 90-day pause on the reciprocal tariffs (except for China), with the S&P 500 posting a near record rally of 9.5% in one day. A good amount of the rally was most likely short-covering though, with Bank of America noting that short positioning was almost twice as big as the size seen during the beginning of COVID in 2020. The market ended the week on a strong note – with President Trump signaling on Friday that he’s open to a deal with China and remarked that he’s “optimistic” China will strike a deal with the U.S. On a less sanguine note, the 90-day pause effectively adds 90 more days of uncertainty. The pause combined with the significant escalation of trade tension with China provides little relief to investors. Notably, U.S. Treasury yields rose 50 basis points over the week, while the U.S. dollar declined—signals that investors are retreating from U.S. assets and that both Treasuries and the dollar may be losing their traditional safe-haven appeal. The shift in sentiment has largely been driven by eroding confidence in U.S. policy amid escalating trade tensions.

Consumer sentiment also continues to crater, and business sentiment isn’t much better, with the small business optimism index falling to 97.4. This is below the long-term average and the largest monthly drop since June 2022. Looking ahead, key events this week include Jerome Powell’s speech on the U.S. economic outlook on Wednesday, March retail sales data, and earnings reports from Bank of America and Netflix on Tuesday and Thursday, respectively.

FOMC Minutes

The FOMC minutes showed us that the Fed is not in a hurry to make any changes to monetary policy. FOMC participants noted that given the labor market is still in a decent position, they are inclined to wait until there is more clarity around government policies and let future monetary policy decisions be driven by the incoming data. Fed officials highlighted that inflationary pressures could prove to be more persistent than expected however, stating that their business contacts were already experiencing higher costs and would pass on tariff costs to consumers. FOMC participants noted that there a variety of factors that will determine the persistence of inflation due to tariffs including: “the extent to which tariffs are imposed on intermediate goods and thus affect input costs at various stages of production, the extent to which complex supply chains need to be restructured, the actions of trading partners in responding with retaliatory increases in tariffs, and the stability of longer-term inflation expectations.” The market still believes the Fed will cut rates in June and is expecting 3-4 rate cuts this year.

March CPI Inflation Report

Headline and Core inflation for March came in below estimates, with headline falling 0.1% for the month (bringing the YoY rate down from 2.8% to 2.4%) and Core increasing 0.1% (bringing the YoY rate down from 3.1% to 2.8%). The increase in Core CPI was the smallest increase since the beginning of 2021, however the future path of Core remains highly uncertain as tariff policies are constantly changing and evolving. Some tariffs were in effect in March, however the scale of tariffs was quite small in comparison to the anticipated reciprocal tariffs.

Core CPI moderated due to large declines in used vehicles (-0.7%), auto insurance (-0.8%), airfares (-5.3%), and lodging away from home (-3.5%). Shelter inflation remains firm, with OER increasing 0.4% and rents increasing 0.3% for the month. Given that the specifics of tariff and trade policy remain opaque, this month’s inflation report likely won’t do much to comfort investors that disinflation is still in place. This goes for the Fed as well – Chair Powell has stated that he is comfortable waiting on making a monetary policy change until there is further clarity on government policies.

Earnings

Earnings season kicked off Friday with JPMorgan, Wells Fargo, and Morgan Stanley all beating estimates—but their commentary reflected growing caution. JPMorgan notably added $973 million to loan-loss reserves, well above the $290 million expected, signaling rising concern about a potential downturn amid ongoing tariff uncertainty. Markets are less focused on current results and more on forward guidance, which remains cloudy. Since December, Q1 2025 earnings estimates have been revised down by 4.2%—a steeper cut than the 5- and 10-year averages. The S&P 500’s projected earnings growth has dropped from 11.7% to 7.0%, while the forward P/E fell to 18.1x due to market volatility. With little clarity on trade policy, companies are bracing for more turbulence and expected to provide cautious or no guidance.

U.S. Treasuries

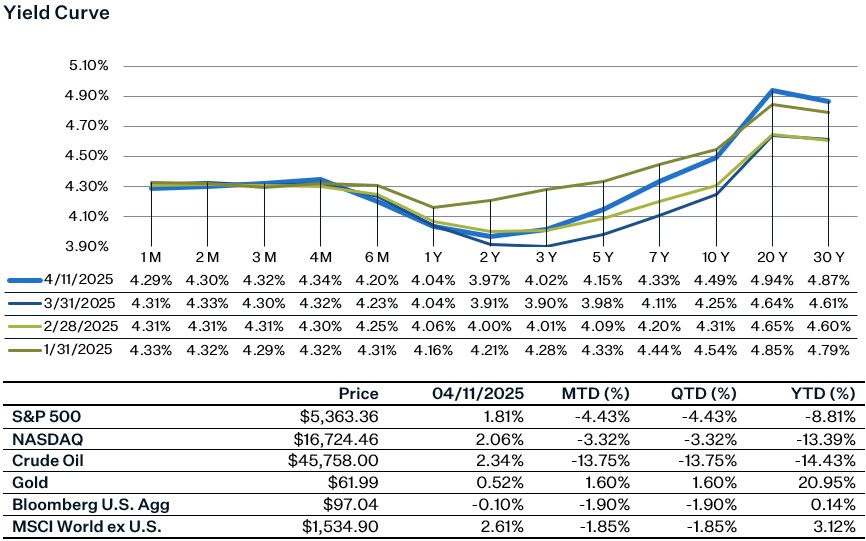

Treasury yields traded in a historically volatile range, with the curve bearishly steepening. A few reasons behind the move are:

- Weakness in stocks and higher volatility have likely contributed to broader deleveraging.

- Investors bought U.S. Treasuries as a hedge which made Treasuries a safe haven asset. Given the current uncertainty regarding policy, the market is not seeing a safe haven bid for Treasuries.

- Growth prospects in the U.S. have been downgraded and if we experience a recession, it is likely that some form of a fiscal package will be proposed. But, with concerns around debt and not knowing how the package will be funded, it is likely that the term premium on long dated Treasuries has increased.

- Sharp selloff in stocks does raise the possibility of larger stock-bond rebalancing where reallocation into equities presents a temporary headwind to bonds.

Sources:

https://www.nfib.com/news/monthly_report/sbet/

https://www.bls.gov/news.release/cpi.nr0.htm

https://www.federalreserve.gov/monetarypolicy/fomcminutes20250319.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4957470-0