Market Update - Ouch

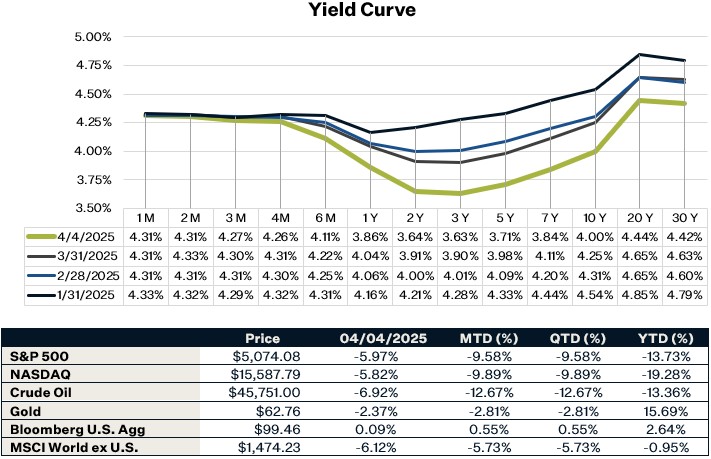

Markets strongly reacted to the announcement of tariffs last week as President Trump unveiled a sweeping new tariff framework, starting with a 10% baseline tariff on all imports effective April 5th, followed by additional country-specific tariffs based on bilateral trade deficits, set to begin April 9th. Investors were caught off guard by the extent and depth of the tariffs which set off concerns around growth, inflation and the ability of the Fed to react. In just the span of two days (Thursday 4/3 and Friday 4/4), we saw markets panic and sentiment turn extremely bearish – with the S&P falling 10.5%, the Dow dropping 9.2%, the Nasdaq tumbling 11.23%, and the 10-year treasury yield dropping to 4 percent. In response to the tariffs, China implemented their own set of tariffs on the U.S. - increasing the tariff rate on all U.S. imports by 34% effective April 10th and imposing export controls on seven critical rare-earth minerals. The tariffs, if not negotiated down, will further deteriorate both consumer and business sentiment which will affect consumption and investment negatively and lower the growth outlook for this year. Even Friday’s healthy jobs report was overshadowed by the tariff news. Heightened trade uncertainty will likely continue in the near-term as more countries attempt to negotiate or retaliate. On Thursday this week we have the CPI inflation data for March, however given that the numbers won’t reflect any of the tariff impacts yet we expect the market to remain cautious even if we get subdued inflation numbers.

Tariff Breakdown

On April 2nd, President Trump announced “reciprocal” tariffs and significant changes to US trade policy, slated to take effect on April 5th with additional tariffs starting on April 9th. The “reciprocal” tariffs are aimed at countries with the highest trade deficits with the United States, which will vary by country, with a 10% minimum baseline tariff. The announcement included a 34% increase to the rate on China (bringing the total increase this year to 54%), a 24% tariff on Japan, and 20% on the European Union. USMCA compliant goods (from Canada and Mexico) will be exempt for now and additional exemptions were granted to pharmaceuticals, semiconductors, and various materials and energy.

The introduction of a blanket tariff on all goods and steep tariffs on certain countries causes further doubt on the disinflation trend. Tariffs are also likely to put strain on the consumer through an increase in prices – most notably the lower-income consumer given that they spend a large share of their income on goods and have smaller savings buffers to weather the hit to real incomes. Sectors and industries that are most exposed to the tariffs include autos, consumer discretionary (most notably clothing, personal care products, household appliances, and home goods), electronics and electrical equipment, and construction and materials. Companies that are able to pass on more of the price increase to consumers should be less likely to see margins deteriorate. Sectors such as utilities and healthcare are likely to be less vulnerable to tariffs as they have more pricing power and are more service oriented. A key uncertainty now is whether these tariffs are opening bids in a negotiation that may lead to lower final tariffs, or if they will provoke retaliatory measures from trade partners.

March Jobs Report

Nonfarm employment for March came in well above expectations, increasing by 228k, versus consensus expectations of 140k. January and February had downward revisions to their employment numbers however, bringing the 3-month average payroll number to 152k. Job growth was strongest in healthcare (+78k), leisure and hospitality (+43k), and retail trade (+24k) sectors. The retail sector saw strong growth though due to 21,000 food and beverage workers returning from a strike. Looking at government jobs, federal government employment declined by only 4k, as employees that are on paid leave or receiving severance pay are counted as employed in the survey. The unemployment rate ticked up slightly – from 4.14%in February to 4.15% in March - which rounded brings the unemployment rate up to 4.2%. Average hourly earnings came in line to expectations, up 0.3% month over month or 3.8% year-over-year. Labor force participation increased from 62.3% to 62.5%, Were it not for the week’s news around tariffs, this jobs report would have been welcomed by investors as a sign that the labor market continues to remain healthy and stable. On a positive note, at least the labor market is still in a solid state entering a time of a potential growth shock.

M&A No More

Wall Street executives are reassessing their expectations for a rebound in mergers and acquisitions (M&A) under Donald Trump, as his policies have instead triggered market volatility and inflation fears. Major banks like JPMorgan, Goldman Sachs, and Bank of America are considering lowering revenue forecasts for their advisory divisions, which may lead to job cuts later in the year. Hopes that lower borrowing costs and rising equity markets would fuel deal-making have been dashed by Trump's recent tariff announcements, which erased $3 trillion in market value and caused the dollar to plummet. Uncertainty around tariffs, geopolitics, and government policy is weighing heavily on business sentiment, with CEO confidence hitting a decade-low.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html