Market Update

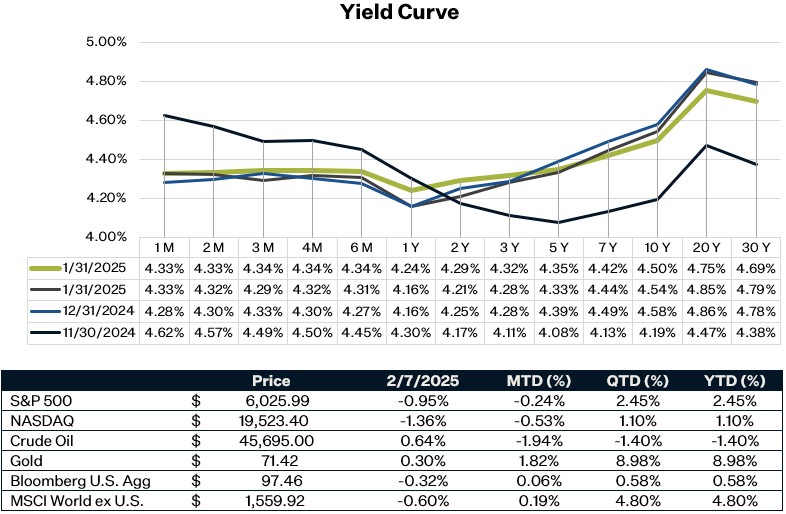

It was quite another turbulent week for markets last week, as the announcement of tariffs reignited fears of higher inflation against an uncertain growth backdrop. Despite delaying the Mexico and Canada tariffs until March 4th, Trump imposed an additional 10% tariff on Chinese imports. In response, China took a more targeted approach, imposing tariffs on 80 U.S. products, launching an investigation into Google, and adding two U.S. companies to its blacklist. Whether or not President Trump and President Xi work out an agreement to remove the tariffs or whether Trump imposes even more/universal tariffs is still very unclear. There is some thought however that the current administration’s policies might not be as business friendly as previously anticipated. The introduction of tariffs is already having a negative effect on consumer attitudes, as consumer sentiment dropped sharply in February and near-term inflation expectations skyrocketed 1 percentage point (pp) to 4.3% while the 5–10-year expectations nudged up by 0.1 pp. This week, investors will turn their attention to key economic data, with the BLS releasing CPI on Wednesday, providing fresh insights into inflation. By the end of the week, retail sales data will offer a gauge of consumer health.

January Jobs Report

Overall, the underlying message of the January jobs report is that the labor market is still in a good position. Nonfarm employment rose 143k in January, slightly below consensus estimates but not that much lower than 166k monthly average we saw in 2024. Healthcare and social assistance (+66k) and government (+32k) continued to lead the job gains along with retail trade (+34k) for the month. Leisure and hospitality saw a small drop in employment (-3k), however this could be due to colder weather than usual. Additionally, job growth was revised up in December and November, which brings the three-month average of job gains to a robust 237k. Other details of the report were also positive. The unemployment rate fell slightly from 4.1% in December to 4% in January, bringing the rate down to the lowest level since May of last year. Average hourly earnings came in strong again, with the year-over-year rate remaining at 4.1%. The job finding rate also increased 1.9 percentage points to 27.3%, which brings it up to roughly the same level it was in September. January’s jobs report reinforces the notion that the Fed is in no rush to cut rates. The likelihood of a cut in June is right now essentially a toss up as investors have increased their probability of the Fed keeping rates steady.

Michigan Consumer Sentiment

Michigan consumer sentiment declined for a second consecutive month as inflation expectations surged in response to tariff concerns, potentially influencing the Fed’s outlook. The sentiment index fell from 74.0 in December to 71.1 in January and then fell to 67.8 in February, with both current conditions and future expectations weakening. A key driver of this decline is rising inflation fears linked to tariffs. One-year inflation expectations jumped over the past two months, from 2.8% in December to 4.3% in February, while five-year expectations rose from 3.0% to 3.3%. The delay of tariffs on Canada and Mexico may ease inflation expectations slightly in future surveys, but ongoing tariff threats, such as those on Europe and Taiwanese semiconductors, could sustain inflation fears.

Earnings

The Q4 2024 earnings season is delivering strong results for S&P 500 companies, with earnings surprises exceeding expectations. Both the percentage of companies beating EPS estimates (77%) and the magnitude of earnings surprises (7.5% above estimates) are above the 10-year averages. As a result, the index’s blended earnings growth rate has risen to 16.4%, up from 13.1% last week and 11.8% at the end of Q4, marking the highest year-over-year earnings growth since Q4 2021. Key contributors to the rise in earnings growth include positive surprises from Industrials, Consumer Discretionary, Health Care, Financials, and Communication Services. Eight out of eleven sectors are reporting year-over-year earnings growth, with six showing double-digit increases. The Energy sector is the only one experiencing a double-digit earnings decline.

Sources:

https://www.bls.gov/news.release/pdf/empsit.pdf

https://www.cmegroup.com/markets/interest-rates/cme-fedwatch-tool.html

https://markets.jpmorgan.com/jpmm/research.article_page?action=open&doc=GPS-4906660-0

https://insight.factset.com/sp-500-earnings-season-update-february-7-2025