Market Update

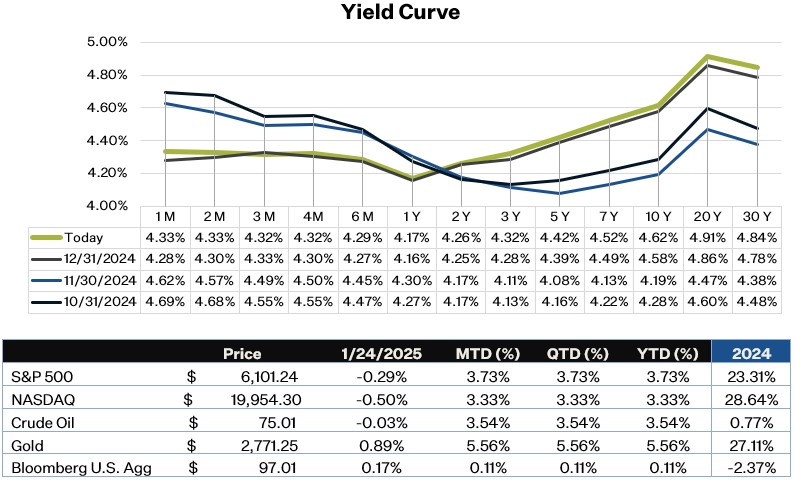

Trump’s inauguration and the anticipated business friendly policies caused enthusiasm among investors last week, with the S&P 500 ending the week up 1.77%. Investors were relieved that Trump decided to postpone any tariffs after previously mentioning he would enact tariffs within the first few days of taking office. His softer stance on China, compared to campaign threats of 60% tariffs, spurred gains in Chinese and broader Asian markets. The absence of any growth surprises caused the 10-year treasury to remain relatively stable last week compared to earlier this month, which further supported equities. This week’s focus includes the FOMC meeting on Wednesday, where the Fed is expected to hold rates steady, earnings reports from four of the "Magnificent 7," and PCE inflation data on Friday.

Earnings

The fourth-quarter earnings season started strong, with the percentage of S&P 500 companies delivering positive earnings surprises exceeding their 10-year average. So far, 16% of S&P 500 companies have reported, with 80% surpassing EPS estimates. The financial sector has been the largest contributor to overall earnings growth, driven by robust results from major lenders. The four largest banks reported their second-most profitable year, as trading and lending revenues benefited from interest rate moves, while investment banking fees surged 32%. This earnings boost is largely attributed to optimism following Trump’s election victory, with expectations of deregulation, increased trading activity, and a rebound in corporate deal-making. As of Friday, earnings growth stands at a remarkable 12.7%, compared to 11.8% at the end of the previous quarter.

Fed Policy

The Fed begins 2025 with a strong economy, balancing full employment and price stability amid a cooling but stable labor market and progress on inflation. Core PCE inflation has eased to an annualized 2.3% over three and six months, though it remains slightly above the 2% target. Key challenges include incorporating potential impacts of Trump’s trade policies, managing his influence on monetary policy, and assessing labor market risks that could trigger rate hikes, particularly if unemployment drops below 4% or wage inflation resurges. Lessons from past tightening cycles, such as the "transitory inflation" misstep in 2021, suggest the Fed will remain cautious about reversing course without clear signals of labor market imbalance or inflationary pressures. Additionally, while lower immigration may balance labor market slack and inflation, the Fed is unlikely to underestimate risks to inflation expectations after recent volatility.

Jobless Claims

Initial jobless claims for the week ending January 18 ticked up to 223k but remained mostly steady and are around the same levels we saw last January. Jobless claims in California were about 10k higher than the same time last year, which could be mostly due to the LA fires, but it is still too early to tell. Continuing jobless claims increased as well and technically reached a one-year high but November and December numbers were only slightly lower than this last reading. This suggests that the unemployment rate is likely to remain around the range we’ve seen the last few months.

Sources:

https://insight.factset.com/sp-500-earnings-season-update-january-24-2025

https://fred.stlouisfed.org/series/ICSA

https://fred.stlouisfed.org/series/CCSA

https://markets.jpmorgan.com/research/CFP?page=article_page&action=open&doc=GPS-4893698-0