Market Update

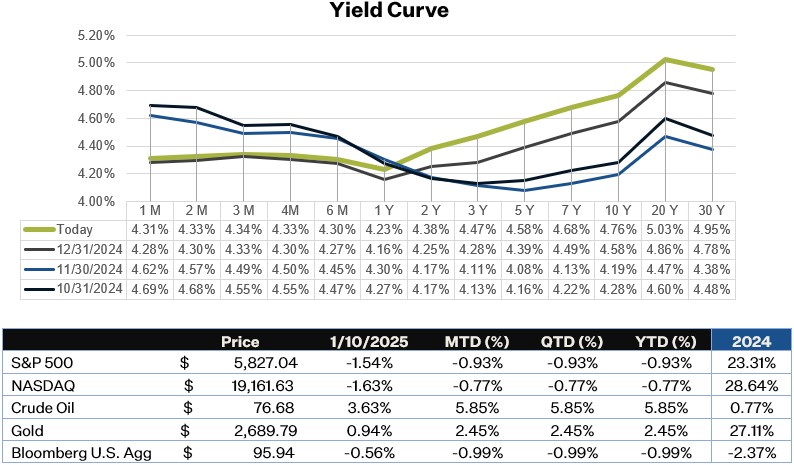

U.S. stocks erased their 2025 gains last week, with the S&P 500 declining over 1.5% as the 10-year Treasury yield rose to 4.77%, the highest level in over a year. This market reaction followed a stronger-than-expected labor market report, which showed higher job growth and a drop in unemployment to 4.1% year-over-year, down from 4.2% last month. Adding to the uncertainty, the University of Michigan’s preliminary January survey revealed that Americans' long-term inflation expectations (over the next five to ten years) climbed from 3% to 3.3%. These reports prompted markets to lower their expectations for Federal Reserve rate cuts in 2025, now anticipating just 1.5 cuts beginning in June or July. The prospect of a higher-for-longer rate environment weighed on equities, as investors anticipated a more hawkish Fed stance, which could dampen growth. Looking ahead, all eyes will be on the inflation report due on Wednesday, with consensus expectations of headline CPI at 2.8%. Earnings season also kicks off on Wednesday, starting with JP Morgan.

December Jobs Report

The labor market ended 2024 surprisingly stronger than expected despite lingering inflation, policy uncertainty, and high borrowing costs. In December, employment growth was notably stronger with job gains of 256k, well above consensus expectations of 155k. Additionally, job number revisions for the previous two months were modest as well at -8k. The unemployment rate ticked down to 4.1% from 4.2% for the month.

Looking at the details of the report, Healthcare (+46k), government (+33k), and social assistance (+23k) continued to be the main industries of job growth. However, in December, leisure and hospitality and retail both experienced strong job growth as well of 43k each, a good sign for consumer spending. The retail jump though could be a one-time seasonal factor due to the holiday season though. Service jobs continue to dominate the job growth, with services industries adding 231k jobs and goods-producing industries contracting by 8k.

Average hourly earnings rose 0.3% month over month (3.9% year-over-year), in line with expectations. On a year-over-year basis, hourly earnings have been around that 3.9% range since August 2024. The labor force participation was unchanged at 62.5%. Additionally, fewer people permanently lost their jobs and more workers left their jobs voluntarily. Lastly, the number of people unemployed for at least 27 weeks fell to 22.7% from 23.9%.

This stronger than expected December print has caused investors to move out their rate cut expectations yet again. The market is now not expecting one rate cut in June and is now essentially pricing in 1.5 cuts for 2025. As such, equities reacted unfavorably on Friday, and the 10-year increased to 4.77% as the market expects a higher rate environment. Given the stronger labor market, and steady inflation, the Fed would be more cautious on cutting rates as they maintain their data dependent framework.

University of Michigan Consumer Sentiment

The University of Michigan’s January survey showed U.S. consumer expectations hitting a six-month low of 70.2, with half of respondents anticipating higher unemployment in the coming year. This decline was most notable among Republicans and independents, and income expectations also weakened. Sentiment continues to be polarized along political lines following the presidential election—Republicans' confidence surged by nearly 34 points after Donald Trump's victory, while Democrats’ sentiment dropped by about 25 points. Meanwhile, long-term inflation expectations rose to their highest level since 2008, driven by concerns over potential tariffs under the incoming Trump administration. Americans now anticipate annual price increases of 3.3% over the next 5-10 years, up from 3% last month, with a similar rise expected over the next year.

Sources:

https://data.sca.isr.umich.edu/fetchdoc.php?docid=77625

https://www.bls.gov/news.release/pdf/empsit.pdf