The Fed has further reduced the expectations of cuts this year to one cut in November, paving the way for higher interest rates.

Higher for Longer: Summary

- We believe growth may be fine near term but will start to slow toward year end: credit fueled consumption is unsustainable and high rates will eventually slow economic growth.

- Inflation continues to cool which could allow the Fed some leeway: however, we are concerned that the Fed could leave rates higher for longer and choke off the wage growth that keeps the soft-landing scenario alive.

- Politics and war represent serious downside scenarios: the reckoning of US debt will be painful regardless of which administration takes it on and if they do not, the looming ratings downgrade could be equally painful while a geopolitical driven spike in energy or commodities prices would likely bring on a global recession.

Market Review: The Fed in Flux

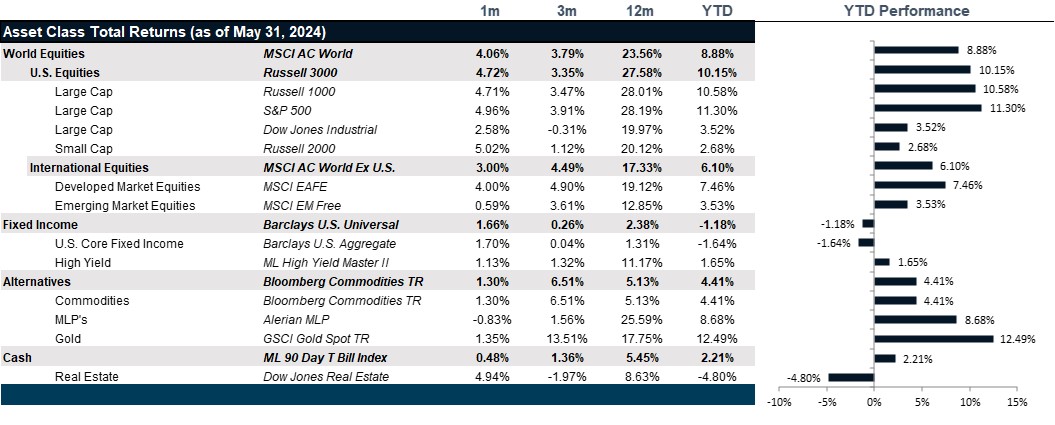

Equity markets took a dovish Fed outlook with growth stocks solidly crushing value stocks through month end as measured by the S&P 500 Growth and Value indices, respectively, with Growth up 6.6% and Value down 3.0% for the month. The risk on stance in the markets extended to size with the small equity index keeping pace with the large cap index performance at 5.04% versus 4.96%. Though macroeconomic data came in mixed and the Fed sat on the fence all month, earnings drove markets up with minimal volatility toward the desperate hope that the Fed would indeed cut.

Meanwhile, the strength of economic data in the US was met with weakness across Europe, so much so that an ECB rate cut was largely expected and on June 9 came to fruition. This two speed global growth story did create challenges as the dollar strengthened against the Euro, making sales to the US from other countries appealingly cheap. Despite grappling with an economic slowdown, European equities still turned in solid performance of 5.05% for the month of May, according to Bloomberg. That said, in Japan, where economic strength led to yen strength, the combination of elevated price to earnings and currency strength led the MSCI Japan Equity Index to lag, turning in 1.32% for May. The broader MSCI EAFE Equity Index came in at 3.98%. Emerging Markets Equities turned in lack luster performance at 59 bps, dragged down by energy dependent Latin American equities.

The bond market, however, always did know how to fret. The Fed in Flux impacted bonds slightly more as the mixed signals in the economy served to keep a kernel of doubt around growth. In addition, the Fed Funds Futures markets began early in the month to price in only one Fed hike in November, a view that was not acknowledged by the Fed until the Jun 12 Fed meeting. Much of the higher for longer pain was experienced in April as the long end of the yield curve threw in the towel and rose in a painful move that left the markets some room to fall over the month as concerns around growth percolated markets. The drop in rates was a welcomed relief after the pain of April, but the canary in the coal mine remains the downgrade activity across high yield, a trend that continues into June. The cooling in inflation may not be enough to offset the concern that the economy is not as strong as the labor market looks. As a result, the long end continues to remain persistently inverted.

The cooling in inflation may not necessarily portent a cooling of the economy, however, but rather simply a reduction in energy prices. In fact, throughout June, oil prices steadily dropped, despite continued tension in the Middle East and a continued war in Ukraine. Much of the cooling in inflation indices from CPI to PPI to Core PCE are largely explained by falling energy prices. Across the commodity futures indices, the Bloomberg Commodities Energy Subindex fell 1.4% while the rest of the energy complex turned in positive performance for the month with agriculture and precious metals contributing significantly. Also in the month, real estate turned in a healthy performance across the REIT indices with the Bloomberg Broad REIT Index returning 5.24% for May. Industrials and Infrastructure were big contributors for the month.

Going Forward: Higher for Longer

After a month of the Fed in Flux, the Fed finally brought the Dot Plot, which is the tally of each voting committee member’s expectations for the final Fed Funds Rate for the next three years and beyond, in line with the Fed Fund Futures expectations. The official expectation is now for one rate cut in November, taking us from 5.25% - 5.5% range to 5% to 5.25% range. The bond markets have responded by doubling down on the notion of economic weakness with the long end falling 20 bps to 4.4%, which ensures continued yield curve inversion if the short end hovers above 5%. Equity markets have largely taken the news negatively in small and mid capitalization equity markets. That said, the equity markets have so far doubled down on the bet on growth with value stocks down 94 bps to date in June while growth stocks are up 5.74% for the month. Meanwhile, the commodities markets are the mirror image of their May performance with oil bouncing back amidst geopolitical tensions and the rest of the commodities complex down dramatically. The first question to understand is the state of the economy, the second is the Fed’s likely response and the final question revolves around other factors that could distort the outcomes.

The Economy

According the the Bloomberg Consensus Survey, GDP expectations for 2024 have been revised up to 2.4%, which is healthy for a mature economy like the US. However, much of that growth has been the result of the buildup of credit card balances, which are significantly more expensive to service and unsustainable. The mirage of labor market strength continues to emanate from worker shortages which are propping up wage growth. Meanwhile, the credit card driven demand is propping up commodity price growth with industrial metals and energy prices showing healthy signs of demand. As we get to the end of the year, credit card fueled demand without a rate cut in sight could get long in the tooth and the prices support in many commodities are unlikely to hold along with earnings and equity multiples.

The Fed

The Fed is driven by the dual mandate of maximizing employment while limiting inflation to 2%. We remain above the 2% goal for the Core Personal Consumptions Expenditures Index, the Fed’s preferred measure of inflation, but we are starting to come into the general neighborhood at 2.75% as of April 30. The Consumer Price Index, meanwhile, seems stubbornly stuck at 3.3% where it has been for over a year after dropping from it’s 2022 high of 9.1%. The remaining fluctuations in inflation seem tied to energy at the top level and to credit fueled demand at the core level. Here, the Fed could easily sit at the 5% to 5.25% range longer than is currently expected. The Fed Funds futures curve prices in a second cut in January of 2025 and economist surveys for 2025 GDP growth see a slowdown to 1.8% for the year. That assumes all goes smoothly.

Politics and War

Politics and War could spell nasty scenarios. First, politics. Market speculators have long been uncomfortable with the level of US debt. The continued high levels of interest rates, while not yet fully appreciated by the consumer household sector, are certainly appreciated in the government sector. Treasury Secretary Janet Yellen recently raised the specter of the budget, though rather than suggesting belt-tightening, which is a notion loosely espoused by the right, she brought up the specter of raising government revenue. Read: higher taxes. If this is the route to balancing the budget, the impact the growth could be swift and potentially deeper than expected. If, however, we see a changing of the guard in November, the promise of continued tax cuts could either cause spending cuts to balance the budget or another credit downgrade which would unleash some turmoil. Neither political outcome is great because the reckoning of our debt will have to come. Second, continued threats to energy prices could back the Fed into a corner that could be very negative for growth and pitch the globe into a recession.

Net View

While equities certainly pose the greatest downside risk, they also continue to perform with healthy momentum. The lack of volatility makes hedging very effective to have the exposure and remain protected from the worst of the downside risks. We remain tilted to US stocks over international stocks. That said, bonds have completed a significant repricing and while they aren’t fully out of the woods, have significantly less downside risk and should warrant a place in a diversified portfolio as higher yields continue to look more attractive than equities.