This month, we focus on U.S. debt, interest rates and their impact to high valuations.

Heads, We Lose. Tails, We Lose.: Summary

- Optimism for a recovery in 2021 has fueled continued upward revisions to GDP despite a rocky vaccine roll out: the continued optimism fueled by anticipated stimulus and economic reopening comes in the face of mixed data, which reveals a weak labor market coupled with surprisingly robust demand data that could only have occurred with past fiscal stimulus.

- Stimulus is effectively demand from the future borrowed and spent today: debt sustainability continues to push yields higher, pulling the dollar and commodity pricing with it.

- A wicked combination of extreme weather- and COVID-related commodity supply disruptions have combined with expected stimulus, demand, more debt, and higher interest rates to stoke inflation fears: However, the data supporting this thesis is rather mixed with labor and income data suggesting a weaker picture while anticipated pent-up demand and a spike in household savings rates suggests a period of demand-driven inflation ahead.

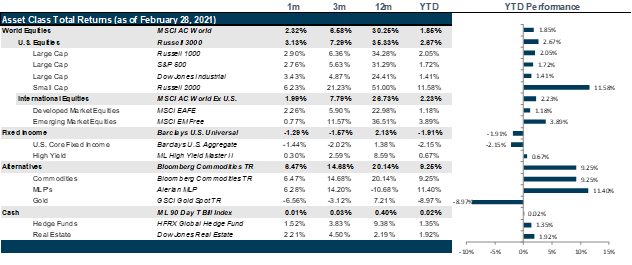

Market Review: Rise of the Bond Vigilantes

Markets in February were influenced by reflation trades in the bond market and changes in monetary and fiscal policy across the world.

Market volatility arising from the short squeeze trade in GameStop and AMC Theatres started winding down towards the first week of the month. While there were some speculation-based trades due to rumors surrounding a possible short squeeze attempt on silver, investor interest gradually shifted back towards earnings announcements and the terms of the upcoming $1.9 trillion stimulus bill. However, the combination of anticipated stimulus, emergency use authorization for Johnson & Johnson’s single dose COVID-19 vaccine, and strong fourth quarter earnings fed inflation concerns. The reflation trade included a selloff in technology stocks as investors started rotating towards cyclical sectors such as Financials and Energy. Exacerbating this fear, an unanticipated polar vortex in Texas resulted in a near collapse of the electrical grid, effectively halting oil production and causing a sudden spike in electricity costs. Making matters worse, as COVID spikes in metals mining countries like Peru and Chile spiraled out of control, mine closures have resulted in rising metals prices for key commodities such as copper and nickel. Further stoking the inflation concern but calming equity market fears of a rate hike, Federal Reserve Chairman Jerome Powell reiterated his stance to maintain the current monetary policy until the Fed’s employment and inflation goals have been met, which stemmed further outflows from the equity markets. However, the benchmark ten-year treasury continued its march up toward 1.5% and the U.S. yield curve continued to bullsteepen with the long end rising faster than the short end, reflecting the Fed’s stance. And, more telling, 2-year and 5-year TIPS hit decade high’s with breakeven inflation expectations above 2.5% and 2.48%, respectively.

European equities were largely affected by the spillover from the U.S. markets. In addition, while U.S. and Japanese economic revisions are still up, European economic revisions have been falling as the vaccination roll out has been a challenge. That said, European equities started to gain traction during the first half of the month as bottlenecks in vaccine supply chains eased up and the European Union began to get their vaccination drive on track. In addition, Italian markets responded positively to the appointment of former President of the European Central Bank Mario Draghi as the new prime minister of Italy. However, as real yields on government bonds have been negative, the reflation trade in the U.S. caused European bond yields to rise and led to a selloff in equities. U.S. investors wary of a market bubble have been diversifying their portfolio geographically into Japan. Despite Japan’s late vaccine authorization, the Nikkei 225 touched the 30,000 mark for the first time in 30 years on foreign investor interest and expected GDP growth linked to the anticipated Summer Olympics.

Emerging markets had a mixed month. Guo Shuqing, chairman of the China Banking and Insurance Regulatory Commission and Party secretary of the central bank, revealed concerns of possible bubbles in U.S. and European markets and stressed on the need to reduce the high leverage within the Chinese financial system. This spurred a fall in China’s equity markets as investors anticipated tighter monetary conditions. On the other hand, improving global economic conditions plus severe weather in the U.S. and Europe drove up demand for commodities, driving up equity markets in the Middle East, Africa, and Europe.

Fixed income markets lurched in February despite existing uncertain economic conditions. Inflation concerns in the market were fairly absent for a large part of 2020 as waves of the pandemic forced lockdowns and stalled recovery. The new stimulus bill proposed by the Biden administration is expected to further increase liquidity in the markets causing bond prices to fall and subsequently yields to rise. Despite unemployment claims remaining high and job losses in December being revised from 140,000 to 227,000, commodity prices have continued to rise, and it is widely expected that the onset of more liquidity will allow the economy to quickly recover in terms of employment but the risk of increasing the budget deficit may result in the economy overheating, causing inflation to rise unchecked.

WTI Crude Oil prices rose to a high of $63.57 per barrel partly due to the production disruption in Texas due to the winter storm and partly in expectation for the OPEC to increase production in response to the global economy normalizing. Gold prices fell to $1739 per ounce as economic recovery and rising treasury yields have reduced its attractiveness as a safe-haven, inflation-hedged asset, while Copper spot prices jumped nearly $2000 per ton on the back of optimistic economic sentiment, growing demand from China, and supply disruptions.

Going Forward: Heads, We Lose. Tails, We Lose.

The road to recovery seems straight forward. A dash of stimulus to offset the lull in jobs and losses in income and a vaccine breakthrough and – voila: a return to life as we knew it. And, yet, it is not that simple.

COVID 19 is putting up an evolutionary fight, mutating into variants that are more infectious and, in some cases, more deadly. The inherent human need to socialize continues to tempt people to take risks they wouldn’t otherwise take. The inherent desire to provide for basic needs, such as food and shelter, forces others to take risks they may not want to take. The result is the same: spikes in infections, public health concerns, and a continued crimp on the economic engine.

Meanwhile, vaccine distribution has marched along sluggishly for various reasons, leaving populations vulnerable to the Darwinian saga. If the first phase of the COVID saga was titled “Unknown Risks” and the second phase of the COVID saga is titled “Everything will be all right in the end”. Then, this third phase should be titled “It is not yet the end.” And, here’s the rub: if the variants cause further human and economic loss, then the bond vigilantes may recede; however, if policies are successful and a recovery forms, then the bond vigilantes may continue to create market turmoil. Heads, we lose. Tails, we lose.

Debt is Future Demand Spent Today

First, the Fed rode in with guns blazing and ultra-low interest rates. Then the government rode in with an abundance of stimulus and no plan for how to get it to where it needed to go and little public health guidance. Then the scientific community rode in with vaccine breakthroughs. Then the government came through with another stimulus plan and little to no help with how to get the vaccine rolled out. And, here we are, a year into the pandemic, with a third stimulus package on the way, a promise to vaccinate every U.S. adult by May, and Texas and Mississippi rolling back mask mandates now rather than after the population is vaccinated.

The resulting economic picture is hard to read. If you zoom out to the rest of the world, it is even harder to read. The problem with global pandemics is that they require a global response, but 2020 was a year where every country, state, county, and city seemed to be on their own. And the result is like trying to control the smoke from a roaring fire. One country’s failings are eventually imported to the rest of the globe, despite travel restrictions. And, yet, optimism continues to pervade across the globe in China because they have largely reopened, in Japan because they finally got their act together and the Olympics are coming, in the U.S. because we just borrowed our great-grand-children’s savings to finance our public health shortcomings, and in Europe because it just can’t get any worse, right?

And, yet, this highly financed optimism has given rise to concerns around debt sustainability and the potential for a resumption of growth to combine with stimulus and ultra-abundant credit to fuel inflation fears for the first time since the Great Financial Crisis.

Mixed Outlook

The problem with the concerns around inflation lay in the fact that the labor market remains weak, income remains weak, and much of the robustness in personal spending has been fed by forced savings during the lockdowns rather than actual strength in income and sustainable demand. It is very hard to envision true demand-driven inflation resulting from this mix of data. However, run-away demand driven by excessive and unchecked credit creation, particularly through the digital shadow banking system, but also through massive debt availability through various federally backed programs could easily give rise to the kind of boom/bust we experienced in the Great Financial Crisis. However, the asset inflating in this case is not necessarily real estate, but the asset markets broadly with excess money growth finding its way into any and every asset, despite lack of intrinsic value (crypto), verifiable value (SPAC’s), or realistic value (equities). In short, the likelihood of traditionally measured inflation is a long shot, but asset bubbles are here.

Rates

“Bond vigilantes are back”, proclaims the Financial Times. James Carville, in response to the “Great Bond Massacre” of 1994, was once quoted as saying, “I used to think that if there was reincarnation, I wanted to come back as the president or the pope or as a .400 baseball hitter. But now I would like to come back as the bond market. You can intimidate everybody.” Consider that in 1994, U.S. Debt-to-GDP was running at 64% rather than the loft 127% we are running today. And, though the U.S. ten-year yield spiked at 7.8% then rather than just at 1.47% (so far) in our most recent run on the yield, we are certainly in a more precarious place in terms of long-term debt sustainability and interest burden as a country while taxes are still at an all-time low to support the most recent spending spree. A rise in rates may not necessarily be a bad thing, particularly for savers, but for borrowers, which is a larger and larger swath of households, corporations, and the government, it could be a game changer for valuations. This is a phenomenon that bears close monitoring.

Net View

We continue to be overweighted small cap versus large cap in the great catch-up trade and are constructive on international equity alongside U.S. equities. We recommend a hedged approach to establish a position in the international markets, while maintaining a hedged position via options and trimming positions in the cash markets in the U.S. to manage risk. We are continuously monitoring the tension between value and growth as growth is suffering substantial setbacks in the wake of the interest rate turbulence. Meanwhile, TIPS have gotten very pricy in the wake of inflation concern and would recommend trimming these positions.