Steadily slowing inflation data has revived expectations for rate cuts this year.

The Global Political Pendulum: Summary

- Recent tragic events provided a terrible wake up call to focus the nation on politics: though equity markets largely shrugged off the Trump assassination attempt, it was a stark reminder that political risk is real.

- Jerome Powell confirmed that we have seen improvement in the inflation towards the Fed target: in addition, the labor markets have weakened enough that the likelihood of an interest rate cut is now higher.

- Bad news is good news for equities as long as it is not too bad: expectations for more rate cuts this year in addition to steady earnings growth all year add up to a rosier equity outlook for now.

Market Review: Fed Clouds Clearing

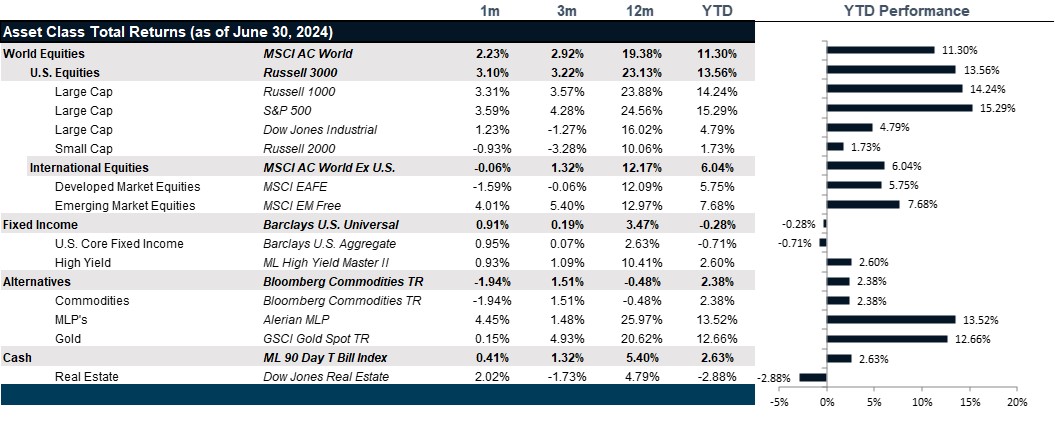

The economy continued to show signs of slowing as falling real incomes are driving lower consumption and slowing bank lending is driving lower business investment. As the soft-landing narrative set in, fed funds futures markets began to price in two cuts this year in November and December for a total of 50 bps to a target range of 4.75% to 5.00%1. That sparked and sustained a rally throughout the month in U.S. large cap growth equity to the detriment of all other segments of equity. U.S. Large Cap Growth equity returned 6.98%1 on a total return basis for the month compared to -0.65%1 for U.S. Large Cap Value over the same period. In addition, U.S. Large Cap equity outperformed mid cap and small cap at 3.59%1 versus -1.58%1 and -2.28%1, respectively. All in all, the markets rewarded risk in all forms: beta, valuation and volatility.

International equities lagged U.S. equities in dollar terms as the dollar strengthened throughout the month on the back of a rate cut by the European Central Bank in early June. The MSCI EAFE Index returned -1.59%1 while MSCI Europe returned -2.16%1 and MSCI Japan returned -0.67%1 all in U.S. dollar terms. In local currency terms, Japan fared better than Europe. That said, in keeping with the beta theme, Emerging Markets equities outperformed U.S. equities, even as Chinese equities dragged performance down. The MSCI Emerging Markets Equity index returned 3.96%1 despite the MSCI China Index returning -1.90%1.

The U.S. yield curve shifted down as expectations for a rate cut continued to build. While that heralded positive performance across the yield curve and across the capital stack, the inherent inverted shape of the yield curve remained intact, still largely calling for a slowdown. Unlike the equity market, bond markets rewarded quality with Treasuries and Mortgages outperforming Credit and High Yield bonds.

Real asset performance was mixed for the month. Broad real estate was mildly positive for the month with industrial and Retail real estate significantly outperforming a recovering office sector and a lagging hotel sector. Commodities performed poorly as the slowdown in China manifested a drag in industrial metals pricing. Oil rebounded for the month but was the only bright spot in the commodities space.

Going Forward: The Global Political Pendulum

The start of July has been packed with political shocks and surprises starting with the first announcement of the French election results on June 30 when the far-right party National Rally shocked Europe by winning the first round of legislative elections, the first time since the far right has held as much political sway in France since World War II. July 4 brough the next major shock when Labour Party candidate Kier Starmer won the British election for Prime Minister, breaking fourteen years of Conservative Tory leadership. Then, in what can only be described as whiplash, the second round of the French elections saw the left wing New Popular Front win the majority of seats in the French Parliament, settling France’s political power just left of center. Meanwhile, after years of increasing political violence which included the shooting of U.S. Congressman in 2017, a kidnapping plot against a state Governor in 2020, the attack on the U.S. Capitol in 2021 and the assault on the husband of a U.S. Congress woman in 2022, the U.S. experienced an assassination attempt on former President and presumptive Republican nominee, Donald Trump on July 13, 2024. Then, Donald Trump announced J.D. Vance as his running mate and to cap off a month of non-stop news, Joe Biden withdrew his bid for presidency, throwing his support behind Kamala Harris. What is abundantly clear in all of these headlines is that public trust is low, the desire for change is high and nothing about elections can or should be assumed.

Equity Markets

U.S. equity markets took the political noise in stride with hardly a blip in performance on the Monday following the Trump assassination attempt. With an upbeat earnings season kicking off and a goldilocks style soft landing in the making, the equity market continued to march higher despite continued evidence of an economic slowdown. We believe this is likely because alongside the economic slowdown, inflation has also finally shown significant signs of progressing toward the Fed’s desired 2% target, raising optimism for as many as three rate cuts this year now expected to start as early as the September meeting. Any concerns about moderate earnings growth are being offset by hopes for valuation support. However, make no mistake, rate cuts would support current valuations, underscoring the fact that rate cuts are essentially priced into equities. Looking at long term averages as a guide, equities could be at least 20% overvalued and vulnerable to any shift in risk appetite.

Bond Markets

U.S. 10-year treasury yields have fallen all month as the yield curve has pivoted around the ten year with the longer end rising modestly. Overall, the inversion of the yield curve continues to suggest an economic slowdown that doesn’t seem to want to reveal itself. While the dynamics of the inversion are unsustainable, the phenomenon continues to wreak havoc on bank earnings, which are expected to slow through year end. Credit risk has fared well with high yield outperforming this year. Treasury risk does seem to contemplate the heavy debt burden while corporate and high yield spreads do not contemplate anything other than a goldilocks style slowdown with monetary support by the fall. That said, the balance of risk still favors bonds over equity at the margin with equity risk facing a much steeper fall should valuations collapse. Absent a collapse, momentum favors equities.

Commodities

Meanwhile, oil prices have been the primary loser in the economic slowdown, particularly as China slows faster than anticipated. In addition, the sudden death of hardliner Iranian President, Ebrahim Riasi, on May 21 paved the way for Masoud Pezeshkian to become President of Iran on July 6, considered less of a hardliner and more focused on reviving the Joint Comprehensive Plan of Action, or the JCPOA. This could provide more downward pressure on oil if Biden remains in office and this gains any traction in Washington. That said, if Trump were to be elected President, the chances of reviving the JCPOA and lifting sanctions against Iran are minimal. Finally, the Biden administration is making progress towards a ceasefire in Gaza. Though there are still significant gaps, the trend is positive. This all paves the way for a slump in commodities that could last through year end.

Net View

While equities continue to pose the greatest downside risk, they also continue to perform with healthy momentum. The lack of volatility continues to make hedging effective in keeping exposure while protecting downside risks. We remain tilted to US stocks over international stocks. We continue to keep exposure to credit to offset equity risk and collect healthy yields.