The recent Fed rate cut will support equity markets, though the health of the economy still remains to be seen. Meanwhile, elections scenarios will be a part of portfolio strategy considerations.

Focus on U.S. Elections: Summary

- Markets are currently mixed on the Presidential race: this suggests that pockets of the markets may not be priced for the various policy outcomes or do not place a high likelihood of policy success.

- Volatility is likely to be feature of either outcome: a split government is rarely effective while a Trump controlled government may be unpredictable.

- The economy holds the key to equity valuations: the Fed managed to walk a tight rope by cutting by more than usual while convincing the markets that this is a not a sign of a deep recession to come but rather done to avoid such an outcome and markets bought it, leaving significant downside if this is not the case.

Market Review: Recession Freak Out

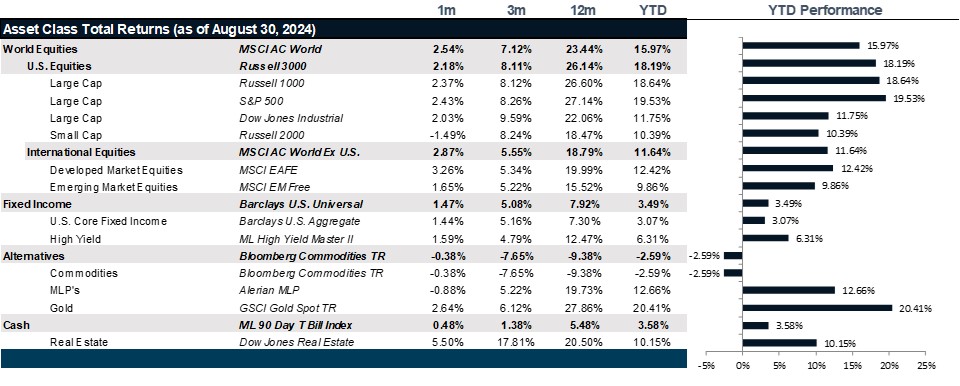

Over the course of August, concern that the Fed was acting too late percolated into a tumble early in the month, fed by a weakening yen. Cracks in the SP 500 started to form toward the end of July as expectations for rate cuts began to rise in earnest. The hit was primarily on the multiple placed on future earnings with price to earnings for the S&P falling to just shy of 21.5x forward price to earnings, according to Bloomberg, which is admittedly still pricey given the current interest rate environment. Much of the concern was focused on the high P/E multiple Technology Sector and concerns that the Ai Bubble was at risk of bursting. By mid-August, however, a broad corporate earnings recovery beyond the “Magnificent Seven” began to take shape delivering their first profit growth since the fourth quarter of 2022. This fueled a rebound through the end of the month and into September as a “buy the dip” mentality came to support the equity markets and reinflate multiples back up to nearly 24x forward price to earnings as of mid-September, according to Bloomberg. By early September, economic growth came back into focus through weakness in China, but quickly recovered and continued to rebound after the Federal Research Open Markets Committee opted to deliver a 50 bps rate cut to ensure that we avoid a recession.

International markets followed the trajectory of U.S. markets though the weakening of the yen brought a sharp dip for Japanese equity markets, though the event felt like a tempest in a tea pot as the markets quickly recovered to new highs by the end of August. September opened with concerns around Chinese demand and Japanese equity markets responded with some softness, but not enough to warrant concern. European equities suffered a shallower dip in early August but rebounded well above July highs, took a breather on the news out of China and shot back up by mid-September after the European Central Bank delivered a 25 bps rate cut ahead of the Fed decision. The Fed’s rate cut seemed to add fuel to the rally. Emerging Markets fared well overall for August and into September with Latin America more than making up for lagging performance in China.

The U.S. yield curve continues to shift down, though the long end is now treading water as the short end is being driven by Fed decisions. With the long-end finally starting to price in some growth after the Fed is done cutting 50 bps this year and 100 bps next year, the soft-landing scenario is very much taking hold even across bond markets. Credit markets acted in line with equity markets with spreads widening out earning August and again in September, though be less. In both instances, spreads recovered to roughly where they began August which is fairly tight and reflects low risk of credit defaults both in the high yield bond markets as well as in the investment grade bond markets.

As expectations for a Fed rate cut were anticipated and ultimately delivered, REIT’s generally benefitted, posting another strong month after a strong July. September has also started strong with Office getting a much needed boost from rate cuts. Meanwhile, with Chinese demand slumping and economic growth slowing, even if in a Goldilocks style, oil prices have slumped and commodities generally turned in lack luster performance. Energy continues to lag in September, despite increased geopolitical risk coming out of the Middle East.

Going Forward: Focus on U.S. Elections

As the clock ticks down to November 5th in the United States, the world is engaged in a complex scenario analysis. Who will win the presidency? Who will win control of the Senate? Who will win control of the House of Representatives? Assuming all of that, what, if any of their platforms will succeed? And, most importantly, what does that mean for your portfolio? Let’s begin with our base assumptions. Since Joe Biden dropped out of the running and endorsed Kamala Harris, the polls on who will win the Presidency have leaned in favor of Kamala Harris, though still within the margin of error for most polls, suggesting that scenario analysis is warranted. Vice President Harris’ entry into the presidential race came just after former President Donald Trump hit a polling high and the former President has yet to recover in the polls from the change in circumstances. Harris’ lead naturally waned as the honeymoon period of her announcement wore off but rebounded immediately after the televised Presidential Debate hosted by ABC News in Philadelphia. Since the debate, most polls show Harris narrowly leading Trump, but continuing to expand the lead as the days pass. That said, however, Republicans look poised to flip at least two seats in the Senate and as many as seven more while only potentially losing 2, leaving the Senate in Republican control according to the Cook Political Report. Meanwhile, the House is a toss up with 69 competitive races. Out of those 69, 24 are truly toss ups, though the Cook Political Report is estimating 221 Republican seats vs. 214 Democrat seats, leaving the Republicans in control of the House.

Harris and a Republican Congress

If polls are to be believed, then Harris would have a very tough time passing her economic agenda. Her housing agenda would benefit home builders that focus on starter homes, though that segment of the market is likely rallying in response to the 50 bps Fed cut. That said, the Harris campaign has laid out plans to incentivize three million new houses with tax incentives to build starter homes and plans to repurpose federal land for affordable housing. If accomplished, the economic benefits of this could last for decades as new wealth is built. However, tax incentives like reinstating the $3,600 per child credit and the $6,000 tax credit for newborn children along with expanding the earned income tax credit to $1,500 and canceling $7 billion in medical debt should be a general boost to consumption, buoying demand and sales. This could already be priced into the still expensive S&P 500. On the flip side, her plans for food price controls and prescription drug price competition and transparency should be a concern for the pharmaceuticals, but they have so far not priced in much concern. Food and beverage stocks are generally down, but more likely on concerns for recession than because Harris will be able to successfully execute on her plans. However, bond yields could be expected to remain low as fiscal impacts are as of yet considered to be manageable. This would benefit bond markets, credit markets and stock markets alike.

Trump and Republican Congress

Perhaps the murkiest outlook is one where Trump is elected into a Republican controlled congress. Trump’s policy agenda is generally assumed to be pro-energy, anti-trade and anti-immigration. Generally, the S&P Oil and Gas ETF has been on a downward slide since March, though we feel this could be more a reflection of the increase in recession expectations around that time rather than an expression of confidence in Trump’s chances to win the presidency. Small Cap stocks are a solid indicator of expectations for domestically focused companies and those have largely been moving sideways all year, giving the markets little information. Meanwhile, correctional facilities could arguably benefit from the anti-immigration stance and these stocks have been sagging since the debate. On the whole, the markets look priced for Trump to lose at this point, suggesting some upside if he were to win. However, since tariffs are considered inflationary and the fiscal impacts of the Trump policy agenda are not considered budget neutral, bond yields could rise in response to this outcome, wiping out much of the bond gains we have seen this year and re-introducing questions around stock market valuations.

The Fed Effect

As I write this, the markets are digesting a 50 bps rate cut by the Fed. Markets were little changed, having already priced in a rate cut of likely more than 25 bps. Now that Fed has officially ended it’s campaign against inflation, the bigger question is whether they will continue to cut aggressively, signaling a much higher chance of recession. The Fed minutes carefully painted a picture of progress toward their target rate while leaving the door open for further rate cuts. That said, they painted a picture of a soft landing. In Chair Powell’s comments, he warned not to price in this pace with the updated dot plot forecasting a median expectation of 50 bps cut by year end, or 25 bps per meeting, and another 100 bps over the course of 2025. The overall impact is likely to support stretched equity pricing into and beyond the elections.

Net View

With a tight election and a likely split between the Executive Branch and Congress, volatility will likely continue to crop up. The closer the call on the election, the more likely this drags into the legal realm and draws out the final outcome, leaving room for uncertainty and unrest which could also stoke volatility. Either way, we continue to expect hedging will be an important element in portfolio strategy.