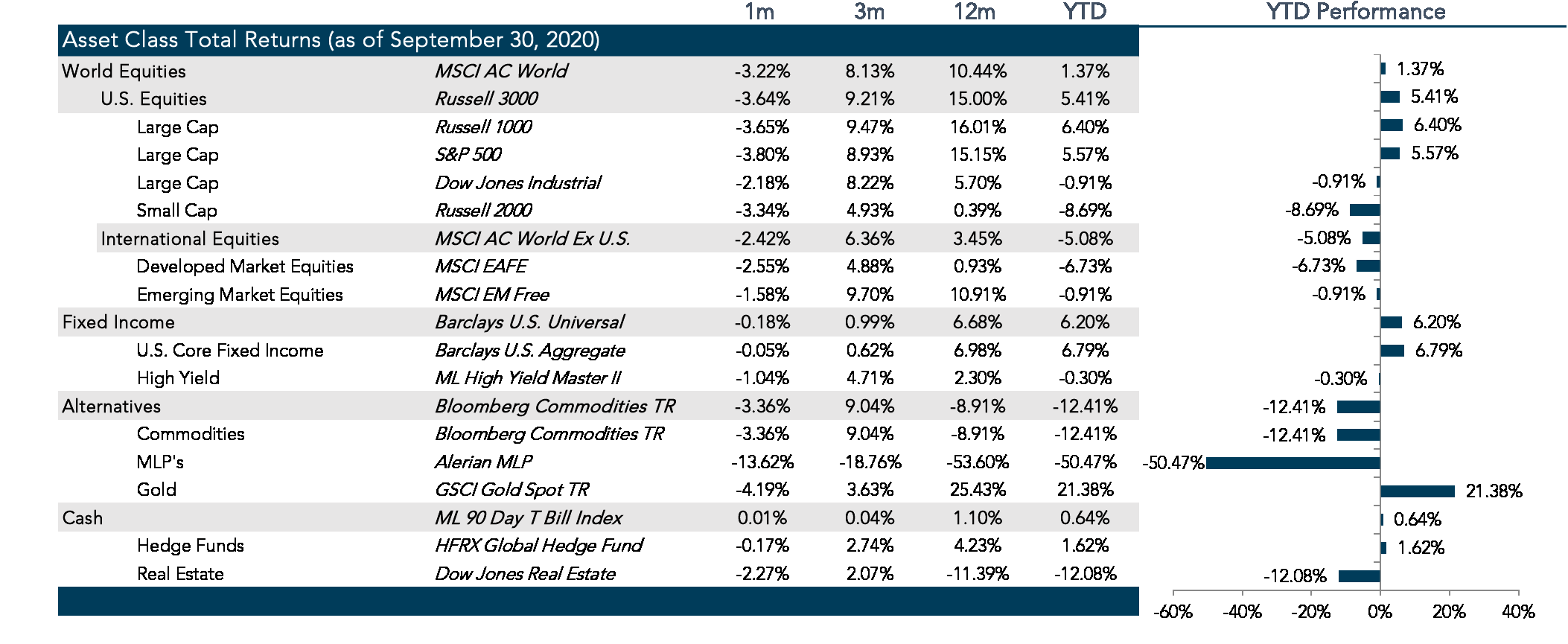

This month, we look at major events affecting the global markets, including the U.S. presidential election, correction in the Technology sector and a spike in coronavirus cases across Europe and emerging market countries. Below is a summary of market performance as of September 30, 2020, as well as our analysis of possible election scenarios.

Election Scenarios: Summary

We considered several possible scenarios regarding the upcoming U.S. presidential elections. Our goal is not to predict odds of winning, but rather to highlight the risks and opportunities of the various scenarios.

- If we remain in the status quo, we don’t see much progress on the current agenda except perhaps infrastructure: U.S. equities and credit look less attractive, emerging markets equities remain unattractive and volatility trades look more attractive along with gold.

- If we have a “Blue Wave,” we are likely to see the most progress on healthcare, infrastructure and social agendas: plans to ease the bankruptcy process could be negative for the credit markets while progressive changes to the tax code could be stimulative for consumption and positive for U.S. equities.

- The “Mixed Bag” scenarios depend on which mix we get: A Trump win/Democratic Senate will keep uncertainty alive. A Biden win/Republican Senate will likely result in lackluster policy execution. Both add up to a shaky outlook for U.S. equity.

Market Review: Risk-Off

Major events affecting the global markets in September have been the upcoming U.S. presidential elections, correction in the Technology sector and a spike in coronavirus cases across Europe and emerging market countries

The U.S. Equity markets witnessed a correction in September. The overall market has been on an upward trend driven by the Technology sector since April for possible reasons ranging from a surge in retail traders on Robinhood to investors rewarding companies for their seamless transition to working from home. However, in early September, news poured out about Softbank holding options on Technology stocks with the underlying notional value around $50 billion and a restructuring in the S&P 500 index which excluded Tesla. These two events contributed to a sustained selloff in the market leading up to September 18, which was a quadruple witching day where stock index options, single stock options, stock index futures and single stock futures all expire on the same day. Markets started recovering in the last week despite steadily high weekly jobless claims and lackluster non-farm payrolls growth.

Equity markets in developed markets apart from the U.S. have had a quiet month for the most part. The selloff in technology stocks in the U.S. markets had introduced some general volatility in European equity markets. However, any major selloff threatening to drag down these markets was offset by investors diversifying away from the U.S. markets in search of undervalued stocks. In the latter half of the month, there was a sharp decline in European markets coinciding with a major spike in coronavirus cases across the UK, France, and Germany. To compound the misery, Britain passed a bill giving ministers the powers to override the Brexit Withdrawal Agreement thereby waylaying negotiations with the EU. So, the outlook abroad remains muddled.

Emerging markets were negatively impacted in September by the selloff in technology stocks in the U.S. markets coupled with an exponential rise in coronavirus cases. The top ten countries in the world with the highest number of total coronavirus cases excluding the U.S., belong to the emerging markets. Global markets witnessed high volatility arising from the increased uncertainty surrounding the U.S. elections in November. This has largely led investors to rotate out of risky assets, thereby reducing their exposure to emerging markets. To compound the uncertainty, war broke out between Armenia and Azerbaijan in the last week of September over territorial disputes regarding the mountainous region of Nagorno-Karabakh. The war threatens to draw in both Turkey and Russia on opposing sides which could have a destabilizing effect across neighboring regions which include the Middle East, Asia, and Eastern Europe.

Over the past month, the U.S. ten-year yield dropped by 3.8 bps. The selloff in the equity markets during the first half of the month had many investors rotate into Treasury bonds, driving up prices thereby driving down yields. In addition, 29 major U.S. retailers have filed for bankruptcy in 2020 with 11 of them happening between July and mid-August. This has reduced investor confidence in a continued decrease in jobless claims as an increasing number of companies including Walt Disney, PF Chang’s and those within the airline, energy and finance sectors continue to announce major layoffs. The continued failure to achieve a second stimulus bill in Congress also contributed to the increased the probability of defaults in the high-yield corporate debt space, which continues to suffer as evidenced by a 40bps widening in spreads since the end of August.

The commodities in focus since March have been oil and gold. Since touching the $2000/ounce level in early August, gold prices have steadily fluctuated around $1950/ounce before dropping to levels of around $1850/ounce in late September as the U.S. economy started stabilizing with falling unemployment claims. However, the controversial presidential debate, the spike in coronavirus cases across Europe as well as U.S. and the massive layoff announcements by companies fueled further economic uncertainty, resurging interest in gold and driving up prices to $1900/ounce as of September end. Crude Oil prices are down by only 3.3% for the month, mainly due to the weakness in the U.S. dollar for the first half of the month. Rising coronavirus cases and lack of a stimulus bill may possibly push down crude oil prices further in the future.

Going Forward: The U.S. Election Edition

No investor expected the roller coaster that would begin right at month end with the White House COVID cluster that included the President himself along with the first lady and several prominent administration leaders. However, the real catalyst to market volatility came from the prospects for additional COVID-related stimulus and the softening macro data, rather than from the disquiet surrounding the President’s health and recovery, which is an important reminder that policy matters more than politics.” So, this month, we delve into the policy platforms of each candidate to consider the risks and opportunities that each candidate will invite onto the economy and markets.

The range of policies is fairly broad, but we will cover a few main areas including social issues, economic issues and foreign policy. Social and economic issues effectively add up to domestic policy and run the gamut from immigration, gun policy, energy policy, environmental policy, healthcare, taxes and social security. Foreign policy includes the broad geopolitical stance, trade and global institutional participation.

The scenarios we consider include the “Status Quo” where President Donald J. Trump wins and the GOP maintains control of the Senate, a “Blue Wave” where former Vice President Joseph R. Biden wins the Presidency and Democrats win control of the Senate and the “Mixed Bag” which includes both combinations. Our goal is not to predict odds of winning, but rather to highlight the risks and opportunities of the various scenarios.

Status Quo

President Donald J. Trump made a series of campaign promises in 2016. Those he made good on include raising trade tariffs on goods imported into the U.S., suspending immigration from terror-prone places, limiting legal immigration, exiting the Paris climate agreement, pressuring NATO to increase spending on joint defense and renegotiating NAFTA. In addition to these, he also accomplished some compromised promises including cutting corporate taxes to 21% instead of the promised 15%, cutting middle class taxes which in actuality amounted to an upper income tax cut, eliminating the estate tax which just raised the threshold in the end, eliminating the EPA which has been scaled back but is still far from gone and achieving energy independence which has not yet occurred though progress has been made.

We expect President Trump to continue to try to make progress on these issues along with the promise of an infrastructure stimulus plan, a return of U.S. manufacturing, a renegotiated Iran deal, a scaled back U.S. Department of Education with additional federal investments into school choice, a reduced school vaccination schedule, an elimination of gun-free zones at schools, a repeal of “Obamacare”, a wall separating the U.S. and Mexico, triple the number of ICE deportation offices and the cancelation of funding to U.S. sanctuary cities. Recent COVID-related promises hinge on a broadly available vaccine. With only the Senate to support these measures, it will be difficult for him to accomplish many of these policy priorities, so we can expect continued compromises with the House for at least two more years if not longer.

Tax revenue has effectively bottomed out and if this new administration continues to push this policy agenda, it is possible but not likely to see further cuts to tax revenues. These revenues have been offset by tariff revenues, but this directly increases prices of goods which may either cause inflation or, potentially pressure margins. With little support of direct consumption and potential for earnings pressure, we are not overly optimistic about U.S. equities and would likely see multiples contract in the U.S. Emerging markets will still be under siege given the administration’s ongoing fight with China and Mexico and that could continue. Credit would benefit from continued support from the Fed, but this would be picking up pennies in front of a steam roller, in our opinion, if credit quality continues to degrade as earnings suffer.

Blue Wave

The “Blue Wave” scenario assumes that Joseph R. Biden wins the Presidential election and Democrats win a majority in the Senate. Looking across the 48-point Biden-Harris policy agenda, it is heavy with social policies such as a plan for tribal nations, an agenda for racial equality, an agenda for women, a plan for full participation and equality for people with disabilities, a plan for veterans and military families, a plan for criminal justice reform, a plan for rural America, a plan for older Americans and retirement, a plan for LGBTQ+ equality, a plan for opioids and substance abuse disorders and an agenda for every ethnic community. At the risk of simplifying these broad social goals, in economic terms, these add up to more efficient use of human capital but aiming to increase participation through broad equality efforts.

Taken in isolation or in combination with his plan for immigration, this could push down wages. However, his policy offset rests in his plan for encouraging unions and empowering workers. Assuming that the latter has any legs, we could actually see both an increase in the labor population as well as a rise in wages. The result must be a reduction of corporate margins, which have been a major driver of multiples over the last decade. While the structure of the labor market (think “gig economy”) has been as much a driver of lower wages, it will be interesting to see how the Biden-Harris administration tackles policy in light of this structural change.

The next set of policies are broadly economic stimulus plans which include jobs and economic recovery for working families, sustainable infrastructure and clean energy future and climate change, a roadmap to reopening schools safely, a plan for K-12 education, a plan for education beyond high school, a plan to support deserving small businesses, a plan for housing and a plan for the reestablishment of American manufacturing and jobs. Taken together, these policies are effectively aimed at consumption as well as productivity.

Many of these productivity policies are largely long-term investments. However, infrastructure and the re-establishment of U.S. manufacturing also has a positive short-term impact of job creation which would be highly stimulative to consumption. The efforts to continue to support small businesses has the potential to be stimulative but is fraught with the potential to be ineffective. The shift in energy policy has the potential to be disruptive, both positively for renewable and clean energy and negatively for the traditional petrochemical industry. On the whole, this should be positive for U.S. consumption and could propel U.S. equity earnings to catch up with the very lofty multiples, which could justify the current optimism baked into equity multiples.

The final set of policies speak to policy reform which have the potential to have mixed impacts on investments. They include tax reform, bankruptcy reform, campaign finance and government reform, the recommitment to the Paris Accord and a broad plan for restoring American leadership globally. At the risk of oversimplifying, these policies generally represent the undoing of many policies established early by or supported by the current Administration.

These policies in sum, represent the segment of policies that have the greatest potential to negatively impact corporate earnings through higher costs to abide by environmental regulation or higher corporate taxes. Bankruptcy reform has the potential to greatly increase corporate default rates and could negatively impact bank balance sheets as well as collateralized debt though higher delinquency rates on autos, credit cards and other asset backed securities. The biggest potential for reprising includes high yield credit and asset backed securities in the investment grade credit complex. There is also the potential for these policies to have some offsetting negative impacts to an otherwise positive equity picture.

Mixed Bag

The most bipartisan positive policy outcome will be an infrastructure plan which has the most potential to have a positive consumption and investment impact on the U.S. economy. However, if that “Mixed Bag” includes a win by President Trump with a shift in the Senate to a Democratic majority, that will likely result in a push and pull between the two political and economic ideologies. We suspect that the only positive element that comes out of that mix is infrastructure while the tenor of the Administration remaining somewhat chaotic. It will be challenging for U.S. equities in that scenario, and international equities may become significantly more attractive.

If, however, that “Mixed Bag” results in a win by former Vice-President Biden with a Republican Senate, it could help to calm the political rhetoric. However, as Biden is largely considered a consensus builder, there may be a significant watering down of his planned agenda, similar to what happened to President Obama when he attempted his efforts at “Obamacare”. The results could be well-intentioned but very poorly executed policies hobbled by compromises which result in the same lackluster environment for U.S. equities. That said, the tone of the administration alone could carry investor confidence higher regardless of policy execution.

Net View

We remain defensive, though given the current polling, we could shift to a more constructive view. Within equity, we continue to maintain our overweight to growth and remain U.S. focused based on our longer-term views of the U.S. market in comparison to the rest of the developed world. That being said, we continue to target opportunities abroad. Within fixed income, we remain neutral. Within commodities we are bullish on gold in relative to the rest of the basket; however this remains a potential hedge against a messy election process.