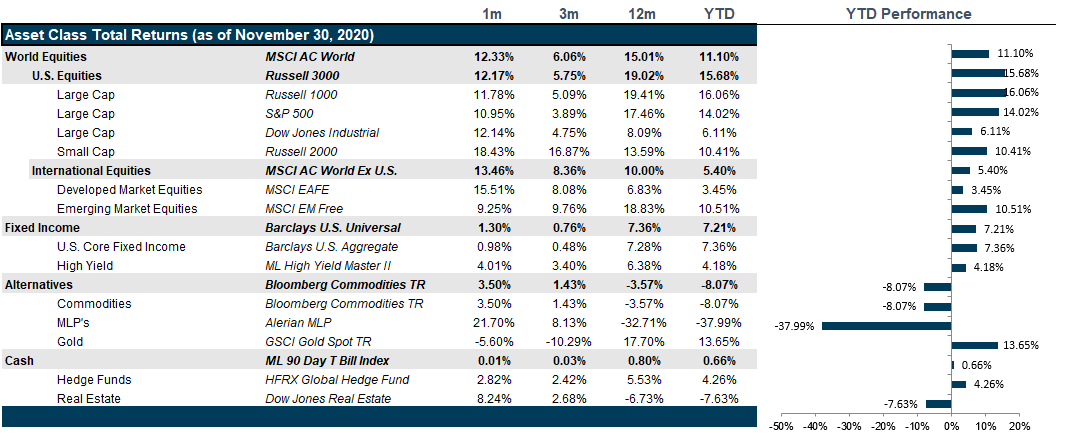

This month, we focus on the results of the election, the worsening second wave of the pandemic, and the potential for a stimulus plan out of the lame duck Congress. Below is the performance as of November 30, 2020. We considered several possible scenarios regarding the recovery of the economy in light of the vaccine announcements. Our goal is not predict what will happen because that is nearly impossible, but rather to highlight risks and opportunities.

Darkest Before the Dawn: Summary

- Equity and bond markets are pricing in a recovery: however, the timing of that recovery will impact how much volatility we experience along the way.

- With recovery on the horizon, price matters: the much-anticipated rotation into value stocks and beaten down commodities is likely to continue through the recovery, subject to volatile moments along the way.

- The path between now and recovery is not without risk: while the timing of the recovery may be top of mind, we note that the scope of the current second wave could create irreparable or longer lasting economic damage before the recovery is well established.

Market Review: Full Steam Ahead

Three main drivers affected markets in November:

- results from the U.S. presidential elections

- rise in global COVID-19 cases

- successful efficacy trials for vaccine candidates

U.S. equity markets trended positively all month. After some initial volatility as the presidential election got underway, the combination of Democratic nominee Joe Biden’s successful presidential race and the GOP’s expected retention control of the Senate spurred a strong rally across asset classes. A change in leadership style tempered with the natural checks and balances that a divided government brings are welcome news for markets.

Further fueling investor confidence, Pfizer and Moderna’s success with vaccine efficacy trials boosted investments into hardest-hit sectors such as energy and financials. However, as the number of coronavirus cases across the U.S. increased to nearly 14 million this past month, the lack of immediately available vaccines fed an undercurrent of defensiveness, further fueling the value rally.

U.S. elections benefited international equity markets even more than U.S. markets as the election of President-elect Biden signals the end of the “America First” international policy stance. Both equity markets and the euro benefitted from the news. The rise in European equity markets, however, lost steam in the latter half of the month as the second wave of the pandemic continued to hammer their medical systems. Adding to that, their own stimulus package continues to remain in limbo due to the objection of Poland and Hungary to attaching the rule-of-law to the stimulus bill. Meanwhile, the Japanese stock markets not only benefitted from the news of Biden winning the elections, but their economy also grew by 21.4% annualized over the third quarter, beating analyst expectations of 18.9%.

Emerging market equities performed well in November, partially as a cascading response to the U.S. presidential reactions and positive news regarding vaccine efficacy. This past month, 15 major countries in the Asia-Pacific region signed “The Regional Comprehensive Economic Partnership”, forming the largest trading bloc in the world and boosting markets in those respective countries.

Many economies in Latin America, Middle East, Africa and Europe also witnessed an increase in investor confidence as they are heavily dependent on the mining and production of oil and industrial metals. Those two commodity sectors had been battered by the lack of demand due to lockdowns, and they now stand to benefit from the return to normalcy expected in 2021.

Over the past month, the yield curve has formed a negative butterfly where the month-over-month increase in intermediate duration bond yields has been greater than the fall in short-term and the rise in long-term bond yields. The CBOE Volatility Index experienced a sharp fall in the first week of the month as election results unfolding across the country started pointing towards a decisive Joe Biden win.

Anxiety in the markets further fell with positive vaccine news, resulting in the tightening of corporate spreads especially high-yield bonds, which fell to 392 bps, just shy of their pre-pandemic levels of 320 bps.

Commodities were mixed in November with reduced uncertainty in the markets buoying the price of West Texas Intermediate Crude Oil just above $45 per barrel and industrial metals, whose demand is forecasted to increase on the back of a global economic recovery. Meanwhile, prices of precious metals and gold suffered overall despite observing an increase in the first week of the month when election results were still uncertain. The fall in the price of gold, however, was not equivalent to the sharp gains observed in the rest of the market, possibly indicating less confidence in an overall economic recovery than indicated.

Going Forward: Darkest Before the Dawn

While the U.S. election was full of dramatic moments, once the results cemented into a clear victory, volatility fell. That combined with the results from vaccine efficacy trial have emboldened markets. However, not every market is signaling a clear and easy path.

The reality is that the road between now and the recovery is fraught with danger emanating from the current second wave gripping the globe. The continued focus of the current administration on overturning the election results continues to distract from a coordinated response to the pandemic, leaving states to act in an uncoordinated way and the potential for significant economic and social damage.

Congress looks closer than many expected to passing a bridge stimulus plan. However, that is perhaps a more negative signal than a positive one since it has taken some eye-popping data to force a vitriolic congress to the table.

Meanwhile abroad, the UK is the first country to pass emergency use authorization for the Pfizer/BioNTech vaccine. And, while that should feel like a great win, the reality is that the December 31 deadline for Brexit is hurtling forward at great speed with little to show for all the negotiation attempts. And, finally, Japan is looking forward to a recovery coupled with the delayed 2020 Olympics and Asian emerging markets having struck a tremendous trade agreement that could spur a supercharged recovery.

United States

In the U.S., the rotation away from the tech rally, while the current focus of much commentary, has only taken a small bite out of the massive gains experienced through the pandemic. Additionally, while the pandemic fueled the extrapolation of pandemic trends such as work-from-home plays, the reality is that the trends were pointing in that direction even before the pandemic. While the momentum may not continue at this pace, many segments of the market may be well positioned to grow into their valuations. However, that does not present much of an appetizing entry point for further investment.

Instead, the rotation into cheaper segments of the market such as energy and financials present much more potential with the recovery, continued increases in global demand from a recovery in general activity, as well as a steepening yield curve and a Fed that has promised to allow momentum to build in inflation.

This has fed breakeven inflation expectations from the pandemic lows in March, rewarding those who managed to grab TIPS at a ten-year low in breakeven inflation. However, the Fed-induced liquidity has also driven corporate investment grade and high-yield debt back down to near pre-pandemic levels, making this segment of the market feel rich but also supported.

Price matters in this recovery as the path will be potentially rockier if vaccine distribution hits any difficulties and if caseloads rise faster than the medical system can handle, leading to more stringent lockdowns and the potential for further impacts to economic activity -- including continued bankruptcy claims, expiring stimulus aid, increasing unemployment and increasing evictions.

Europe

Europe is moving swiftly with agreements already in place with Pfizer/BioNTech to purchase vaccine doses in Europe and in the UK -- well ahead of the U.S. agreements -- and they are moving swiftly to approve use and distribution of vaccines through national health systems. This coupled with the much cheaper valuations make European equity look attractive.

However, though much of the 600-page text is complete, there are sticking points that are significant, including legal standards and dispute resolution (and fishing rights).

With the world focused so intently on the pandemic and vaccine, the Brexit deadline at the end of the month is not fully priced into the market, leaving us unwilling to dip a toe into this water until we know just hard this hard BREXIT will be.

Asia

Japan will experience the double benefit of a recovery, coupled with an Olympics to spur demand across the Asian archipelago. However, the big news out of Asia is the Regional Comprehensive Economic Partnership, an agreement between 15 member countries and 30% of the world’s population. While critics have called the agreement “a China-style trade agreement: platitudinous and ineffective”, the reality is that it brings together three key players who before now did not have an trade agreement: China, Japan and South Korea. We view this development as significant and worth watching as markets develop.

Net View

We remain defensive through the transition.

Within equity, we see further opportunity in value while maintaining a healthy recovery portfolio with growth exposure.

Within value we remain interested in names that may benefit from any economic disruption we may feel from the current second wave. We remain neutral on international equity and fixed income.