Market volatility has set in and looks to be the norm for the remainder of the year. Options protection and rebalancing will be useful tools in this environment.

A Cruel Summer: Summary

- Bond markets look to have been right all along: we continue to see more signs of slowdown and the potential for recession continues to rise as weaker data emerges.

- Equity markets remain mixed: sectors more closely tied to the real economy have struggled this earnings season and have priced in a slowdown while other segments of the market remain overvalued resulting in a murky overall equity picture.

- Volatility is king: rebalancing will remain key to surviving the volatility storm.

Market Review: Surprise, Shock, Repeat

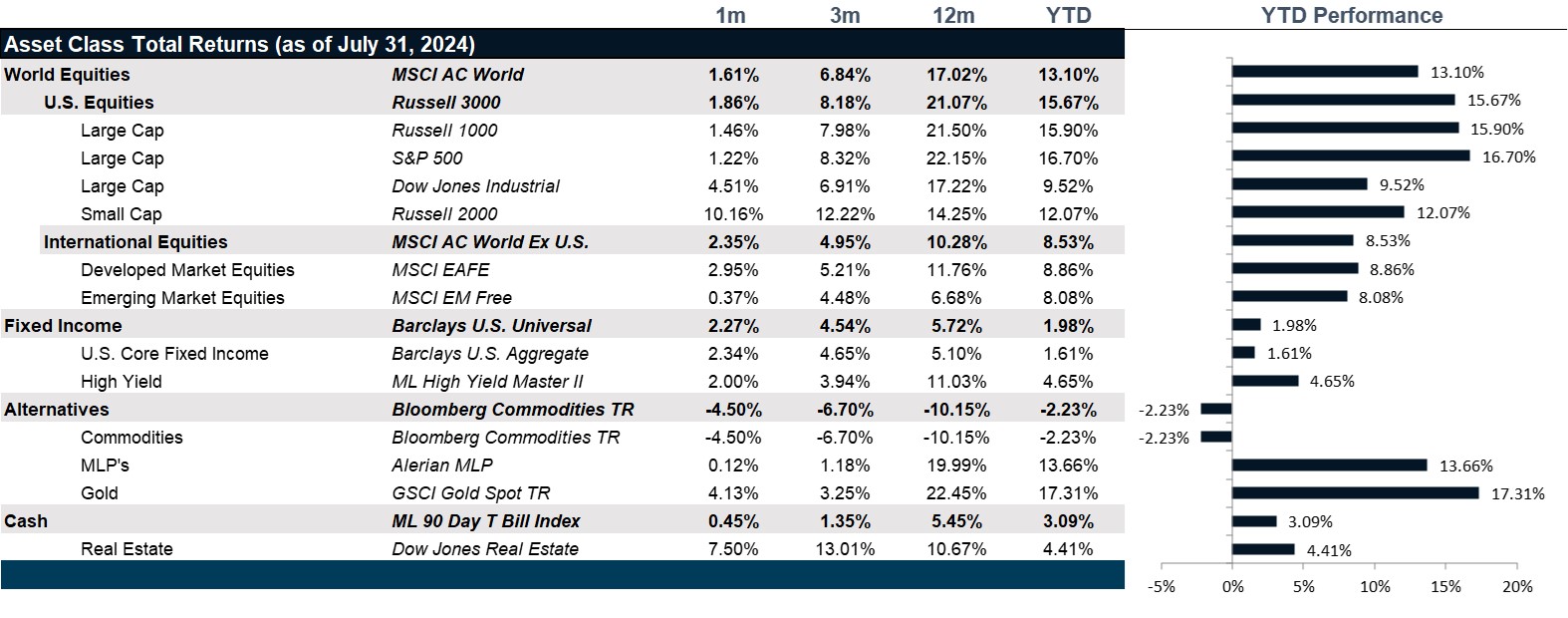

Despite the many political news bombs dropped on the market in July, U.S. equity markets started July unfazed by the political drama as measured by the S&P 500 through July 15, 2024. The latter half of the month, however, began an unravelling in the Technology landscape as the air began to go out of the Ai hype cycle and set the stage for the volatility that greeted August equity markets. Meanwhile, old economy stocks, as measured by the Bank of America Old Economy Equity Index and small cap stocks as measured by the S&P 600 Index returned 2% and 4.85% for the latter half of the month, according to Bloomberg. For the total month of July, the S&P 500 returned 1.22% while the S&P 600 returned 10.79% and the Old Economy stock index returned 5.76%, according to Bloomberg. This is notable as these are largely seen as surrogates for the “Trump Trade” and suggest that while the players may have change and polls may look tighter, the markets pricing has not changed.

International equities rebounded in July as the U.S. dollar weakened against a basket of global currencies. However, this bucks the trend set all year of international weakness, particularly after the Japan trade faltered after the first quarter of this year. It has largely remained range bound since April along with the international markets generally, largely reflecting dollar strength and weakness rather than fundamental price drivers.

The U.S. yield curve continues to shift down, reflecting a bearish outlook and anticipating that the Fed could cut more than currently priced in. Credit and high yield bonds continue to drive aggregate bond index performance, according to Bloomberg, though U.S. Treasuries also benefited from the fall in yields. The spread over treasury yields for corporate and high yield bonds, however, remained compressed, despite the volatility in the latter half of the month.

Real assets returns were largely driven by real estate performance. Within real estate, retail and industrial REIT’s accounted for the majority of the returns with Office returning 7.12%, Retail returning 10.56% and Industrial returning 12.68%, according to Bloomberg REIT indices. It is worth noting that the much-maligned office REIT returned a heroic 10.97% as measured by the Bloomberg Office Property REIT Index. Commodities, however, performed poorly with the exception of gold, reflecting the risk-off trade that began to take hold of the markets in the latter part of the month.

Going Forward: A Cruel Summer

With the presidential nominees and their respective running mates now established, with all of the surprises and shocks that entailed, markets are refocusing back on the economic reality of the here and now. The unwinding of the yen carry trade sparked a sell off early this month that was exacerbated by weaker and weaker macro-economic news. While weak economic news used to be a reason for cheer in the markets, because it allowed the Fed to cut interest rates sooner, the markets are now reading such news as sign tight Fed policy has now gone too far and will tip the economy into a recession. Lower interest rates can only support already high valuations. They cannot do anything about weakening demand and the subsequent slowdown in earnings now pervading earnings calls. The only question now is whether the current slowdown becomes a full-blown recession. Economists are currently divided on this call with some saying that we are already in recession and others saying that we are not in recession. However, there is no question that the U.S. economy is slowing.

Priced for Recession

An official recession occurs when the U.S. experiences two consecutive quarters of decline in the real (inflation adjusted) gross domestic product (GDP). With inflation down to 3% and consensus forecasts for nominal GDP growth of 1.7%, a mild recession is the expectation. In addition, the yield curve, which has remained stubbornly inverted for more than a year certainly indicates recession but has done so for so long that it is starting to feel like the little boy crying wolf. Meanwhile, yields have largely run in place, rising in April as optimism started to take hold and falling back to the same levels at the start of the year as reality has set back in. Commodities have traced the same path, peaking in May and falling back to just below the same levels as the start of the year. We started pessimistic, got optimistic and then got pessimistic again.

Priced for a Slowdown

Not surprisingly, the market with the rose-colored glasses on remains the equity markets. That said, the overall U.S. equity market covers up a tail of three markets. The first market is the commodities trade, where earnings have been massacred for the past four quarters. Energy and Materials have been in an earnings trough and have lagged the otherwise buoyant market all year. This segment of the market is forecasted to make up ground over the next four quarters. The second segment of the U.S. equities market is the hype markets. Technology and Communications sectors have experienced the Ai hype cycle with valuations in both sectors well above long term averages and very hard to justify except for the Ai hype and that seems to be slowing. In addition, healthcare has experienced it’s own GLP-1 hype cycle with very high valuations priced in which is not yet slowing. Finally, the last market is the rest of the economy with sectors like consumer discretionary, staples, financials and real estate, all of which are expected to slow with the slowing of the economy. Each of these stories will respond differently to the slowdown with the hype cycle markets most exposed to a slowdown with such high valuations. Because the real economy sectors are largely already priced for the slowdown, they are far less exposed.

Continued Volatility

The volatility we have recently experienced, however, is likely to remain. Considering that the geopolitical landscape is still unsettled and with the U.S. busy in an election cycle and a lame duck presidency, it will be a challenge for the U.S. to effectively make headway. In addition, while the election tickets are now determined with running mates, rallies and fundraising, neither candidate has explicitly discussed meaningful policy discussion. Granted, we can expect that Harris’ policy stance should follow the trajectory of the Biden administration and the Trump policy stance should reflect similar policies to those he enacted under his own administration. That said, neither side has explicitly laid out policy priorities, so there is much that is yet unknown and that begets uncertainty. Moreover, with polls now so tight, the likelihood of a peaceful transfer of power has now fallen considerably, which could also fuel volatility. We see rebalancing as key to surviving the price swings we expect for the remainder of the year.

Net View

Equities have finally begun to exhibit volatility that could portent a rest in valuation and we take this exposure to neutral. We remain tilted to US stocks over international stocks. We continue to keep exposure to credit to offset equity risk and collect healthy yields.