This month, we focus on balancing the market reopening with the uneven path to recovery.

Cautious Optimism: Summary

- The GARP trade continues to be the dominant theme in the markets: equity investors are optimistic about a reopening and resurgence of growth and the need to participate in that growth story, but are investing with an eye towards valuation.

- The pause in the bond market referendum is creating further opportunity for a risk-on market: the Fed’s role in putting a pause in the rise in yields has been key in the short term.

- The inflation story is likely a short-term story but bears watching: while the elements contributing to mounting inflation pressures are short term in nature, there is still some risk of longer term inflation that should not be ignored.

Market Review: Uneven Recovery

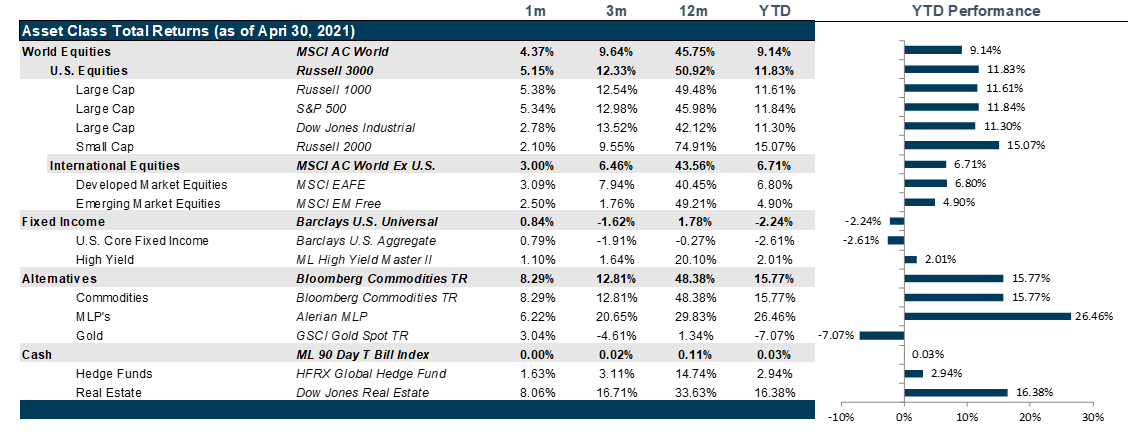

Markets in April were influenced by the first quarter earnings results, increasing Covid-19 mutations and macroeconomic variables.

After the blowout of Archegos Capital in March, U.S. markets have bounced back in April on the back of falling unemployment claims and a stellar earnings season. Weekly jobless claims fell from 700,000 to 550,000 during the second week of April and has remained steady since, while the economy added 916,000 jobs in March. The Federal Reserve has continued to reaffirm their current stance holding rates constant at 0.25% and not tapering bond purchases in the near future. This has effectively driven down interest expectations in the near term driving down the intermediate to long end of the yield curve. As the job market continues to recover, people’s income and consumption levels have risen as evidenced by the most recently reported 116.58% earnings growth in the Consumer Discretionary sector. In addition, President Biden has proposed increasing the capital gains tax rate to nearly 40% as well as increasing the corporate tax rate by 7% to 28% along with pushing towards the establishment of a global minimum tax rate wherein companies’ foreign income would be subject to a tax of at least 21%. The markets have taken the tax proposal in stride with little impact to date.

International markets have had a varied performance over the past month. European markets rose to an all-time high over the past month in response to the vaccination drive gaining pace and a comparatively better earnings season. While reopening their borders to vaccinated tourists for the summer season may push equities higher, European markets continue to remain on tenterhooks as investors continue to monitor the reports of blood clots from Astra Zeneca and Johnson & Johnson Covid-19 vaccines and their effect on vaccine rollouts. Japanese markets on the other hand have underperformed over the past month as the government declared a 3rd state of emergency to combat rising cases while their vaccine rollout continues to remain painfully slow with only 0.8% of the population completely vaccinated.

Emerging market remained flat in April, lagging other global indexes owing to the spike in new Covid-19 cases across Brazil and India which resulted from a set of new mutations in the virus and a slow vaccine rollout. As developed economies continue to reopen, demand continues to rise and due to shortage of supply, commodity prices are also rising which both helps and hurts EM nations depending on whether they are importers or exporters. In addition, Alibaba was fined 18.2 billion yuan for monopolistic practices and while investors remain concerned about further anti-trust cases against Chinese technology behemoths, a one-time fine reduces the uncertainty for now.

Intermediate to long term U.S. Treasury yields fell over the past month in response to the Federal Reserve keeping interest rates steady, while Euro benchmarks witnessed yields rising across the spectrum as the European Central Bank indicated phasing out emergency stimulus when vaccinations levels reach a critical point and the economy develops momentum. However, there is increased expectation that central banks across the world might be forced to raise rates to combat rising inflation as evidenced by the Bank of Canada tapering its bond purchases.

WTI Crude Oil prices closed the month at $63.86 per barrel. Scarcity of goods and excess money supply in the markets has led to commodity prices soaring, leading to inflation concerns and gold prices surging from below $1700/ounce to $1781.76/ounce in April. While the Federal Reserve and Treasury maintain that inflation will likely be transitory in nature, the new infrastructure plan announced by President Biden could result in a longer period of inflation driven by stimulus driven demand which could in turn result in a significant rally in prices of raw commodities such as lumber and copper. With home prices at a new record high and demand exceeding supply, the construction industry has been caught flat footed and 1000 board feet of lumber now costs well above $1000, nearly 4 times the pre-pandemic average. Wheat prices also rose to $7.36 per bushel on reports of high demand from China where feed buyers are incorporating more wheat into their feed mix as corn prices remain persistently high and the government has recommended reducing their reliance on corn and soybean. In the cryptocurrency space, Ether rose to an all-time high on interest from major financial institutions around the world in the Ethereum network especially with reports of the European Investment Bank planning to sell digital bonds using this technology.

Going Forward: Cautious Optimism

As the pandemic reopening of the U.S., the U.K. and to some degree the EU are finally starting to take shape, they are all still fraught with ebbs and flows in risk appetite. Faith that the reopening will occur and that there is significant pent-up demand is at odds with the concern that the reopening is not yet global and that supply chain disruptions still create a challenge to the reopening. And, of course, there is the ever-present Darwinian reality that this virus continues to mutate as long as it finds hosts to attack. So, until global heard immunity is reached, the reopening will have challenges. Growing pains will likely continue as job openings grow but recruitment remains challenging. Supply chain disruptions and shipping and logistical challenges also remain top concerns. But, ultimately we are constantly reminded that the pandemic is not yet over and by extension, the pandemic rebound has risk.

Equities

Otherwise known as the “view from the bottom” equities are normally the most optimistic part of the market as they are the last in line to be paid. And, this part of the market has flirted with a risk-on shift, but so far, it hasn’t persisted. We continue toThe combination of the reopening trade, concern about inflation and the debt mountain forming have pushed yields up while Fed Chair Jerome Powell continues to talk the bond markets off the ledge. The most recent pledges to maintain easy monetary policy has managed to put a pause in the steady rise in ten-year yields. However, it has not quite broken that trend, but rather sent yields into a holding pattern. This wait-and-see mode could still usher in more pain for the bond markets. Meanwhile, credit continues to experience a goldilocks moment of upgrades with upgrade to downgrade ratio strong in the investment grade space and historic in the high yield space. This is pushing investors to continue to pick up pennies in front of the proverbial steamroller as the underlying fundamentals are not quite in line with the upgrade activity. So, the pressure is on the Fed to keep this party going or risk a return to the bond market referendum on debt, inflation or both. see growth-at-a-reasonable price (GARP) strategies outperform, essentially because investors believe that growth is key at this stage of the recovery, but are unwilling to invest into significantly overpriced segments of the market. We see this continuing until key segments of the Emerging Markets like South Africa, Brazil and India and poorer nations in general get control over the spread of the pandemic. U.S. equities has traded well ahead of international markets while developed market equities have significantly outpaced EM equities. We see this continuing until vaccines reach the rest of the world. That said, we also see unlocked value in the international, non-China segments of the economy as those economic openings are not yet priced into the markets.

Inflation

There are several reasons that inflation remains a concern in the markets. First, the short-term shortage of workers resulting from fear of infection, lack of child-care and in-person school access and the ability to ride out the next few months of jobless benefits is creating challenges for companies trying to reopen. Second, the shortage of commodities resulting from exogenous factors such as the drought in Taiwan exacerbating the shortage of semiconductors to COVID-related copper and nickel mine closures has driven raw goods prices up and will likely continue to do so until commodity exporting nations can effectively and fully reopen. Finally, logistical logjams from shipping to trucking add to the risks faced by companies in the reopening. So, the road to reopening is hardly clear or simple and will likely take longer than expected, driving up prices in the meantime and keeping inflation fears alive and well, if only for the short term. And, while the likelihood of longer-term structural inflation remains low for now, there are some policy initiatives that could certainly change that outlook including changes to minimum wage policy and a push towards increasing collective bargaining power by labor unions.

Net View

We continue to overweight small cap over large cap in the U.S., despite a breather in March and continue to overweight value and GARP versus growth in the great quality rotation.