We explore the challenges of market peaks and the psychology of downward revisions.

Boo!: Summary

- Political gamesmanship will likely ensure that the debt ceiling angst will persist into 2022: Though the immediate risk of default seems to be falling, the risk level in the U.S. will likely remain high through year end.

- Demand continues to outstrip supply, throttling the recovery: the greatest threat to the recovery continues to be the mismatch between the recovery where goods are primarily manufactured vs the recovery where goods are primarily consumed, creating headwinds to the recovery in the form of lower consumption and higher inflation.

- As we shift into the next phase of the recovery, more clarity is forming on fundamental value: pricing across asset classes will be greatly determined by the future stimulus on the table, as well as the expected path of monetary policy.

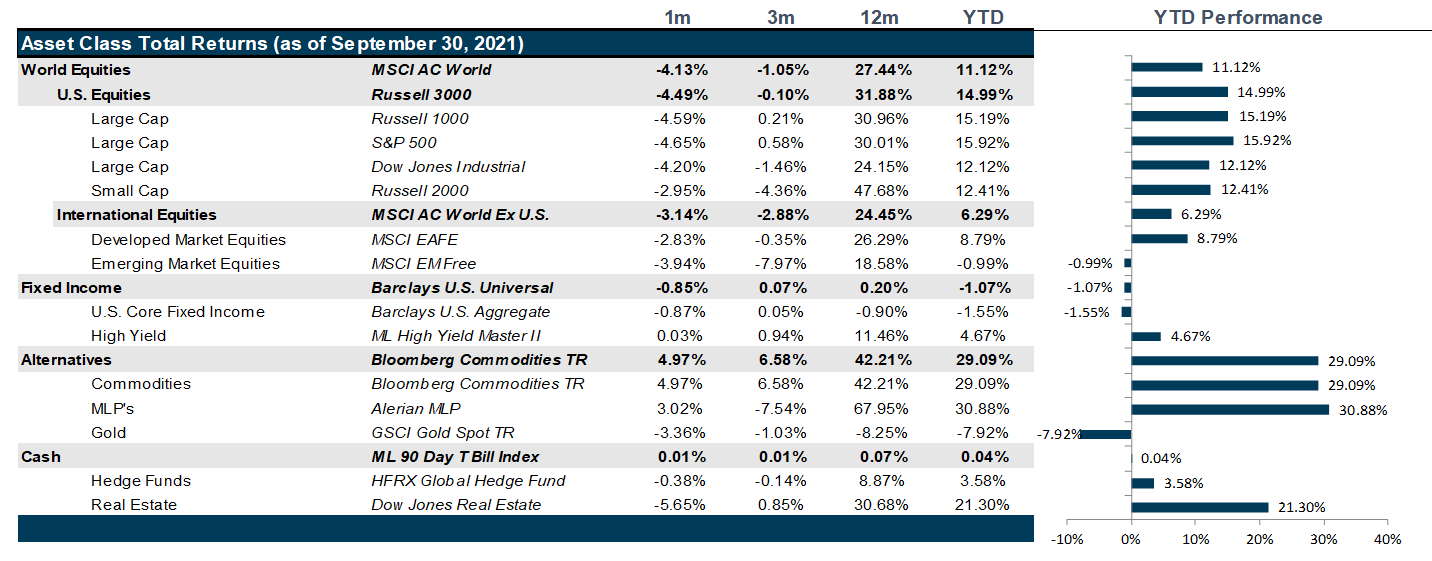

Market Review: Multiple Risks

Political factors, rising inflation, debt crisis and a major energy crunch drove volatility in September and into October.

September saw U.S. markets sail into choppy waters. To begin with, nonfarm payroll numbers for August were disappointing with average economist expectations 498,000 higher than actual data release. Focus then shifted towards the Federal Reserve whose monetary policy decisions are meant to ensure maximum employment and low, stable inflation; however, as inflation continues to remain high, markets continue to anticipate tightening monetary policy sooner in 2022. Feeding the inflation pressures, Covid-19 continues to mutate around the world forcing local governments to introduce temporary lockdown measures leading to bottlenecks along the supply chain, already under pressure from the strong, recovery-driven demand. By the second half of September, focus then shifted to new sources of risk including the collapse of China’s second largest property developer the Evergrande Group and the last-minute dash in Congress to keep the government open. And, though they crossed that finish line right at the end of the month, Congress has yet to agree on raising the debt ceiling, which could trigger the first U.S. default in history. Moreover, the drama of passing Biden’s ambitious spending bill continues to dominate the news cycle.

International markets fell in line with the U.S. albeit for different reasons. Europe witnessed a record rise in energy bills the past month. Vaccinations have powered an economic recovery, however as a tough winter approaches, countries in the northern hemisphere have started increasing their stockpiles of energy reserves, resulting in limited gas exports from Norway and Russia towards Europe. In addition, the OPEC+ continues to increase oil production in a steady systematic manner despite demand growing exponentially, resulting in oil prices surging. Rising energy costs and threats of blackouts have already resulted in many industries reducing the production capacity at their plants. The European Union’s transition towards renewable energy has also contributed to this energy crisis by further reducing capacity. Among developed markets, Japan was a standout as the Nikkei 225 gained 3.52% MTD as infections levelled off, vaccinations rose dramatically and local officials lifted lockdowns.

Emerging markets in the Asia-Pacific region were some of the worst affected by the collapse of the Evergrande Group, while high inflation continues to be the bane of Latin America. In addition, an energy crunch has forced a production slowdown in China, leading to a surge in commodity prices, which continues to hamper central banks’ efforts to fight inflation in Latin America. Russia and the Middle East witnessed strong performance over the past month owing to the gains in oil and gas prices, while India has continued to perform well as infections have levelled off and progress on the vaccination front has been steady.

The yield curve steepened considerably towards the last two weeks of the month as the Congress dragged out the process of averting government shutdown to the last minute. In addition, the continuing supply chain logjam, and energy crunch felt in Europe, China, and other parts of the world, has led to considerable increase in inflation expectations among investors. The Federal Reserve continues to hold that inflation is transitory. However, if the period of transitory inflation maintains for much longer than the Fed can sustain, we might see the Fed accelerating their timeline of rate hikes and bond tapering once again, which will further spook markets.

WTI Crude Oil prices rose to $75.53/barrel and Natural Gas to $5.65/MMBtu as an energy crunch crisis unfolds in Europe and China. The OPEC+ has been ramping up production steadily after the record output cuts they made last year during the peak of the pandemic. China’s state-owned energy companies have been ordered to secure supplies for winter at all costs, as weak output from hydropower has forced several regions to cut power to the industrial sector. This production crisis in China has also resulted in a rally in other commodity prices especially within the agricultural and industrial spaces. Silicon prices have surged by nearly 300% over the past two months as the transition towards greener energy sources has resulted in a massive demand for semiconductors, and cryptocurrencies suffered a major setback this month as China’s central bank effectively banned them and declared all transactions within the space as illegal.

Going Forward: Boo!

October always feels scary, but statistically, the chances are not different than any other month to be the worst month of the year. And yet, here we are staring down what feels like a tsunami of risks that just hit the economic ocean shelf of recovery and has built up to monumental heights quickly. So, will this pass or will there be significant destruction as a result? The answer is quite different for each risk facing the market, but it is worth discussing the individual risks to understand the total risk facing the market and the direction of risk and volatility from here.

The Recovery Revision Cycle

Because of vaccinations, the recovery cycle is out of sync globally with China entering recovery first, followed by the U.S., then Europe, and finally Japan. However, many emerging market countries such as Vietnam or Peru are still struggling to vaccinate their populations and are stuck in lockdowns and the outlook for the recovery of EM’s is still well into 2022. However, for the more developed economies, the initial upward revisions and optimism collided with the Delta variant in late August. China was already well into downward GDP and earnings revisions; however, the U.S. was just peaking as an economy. Europe was just starting to hit its stride in the vaccination race and Japan was struggling under the Olympics. Fast forward to now, most country GDP estimates are now on the downward side of the revision cycle and earnings growth will be compared to stronger and stronger quarters going forward. And, while in absolute terms, we will see stellar growth across the developed world, much of that is now priced in, and pricing will return as a driving factor. While growth remerged as a dominant factor in the markets, value is starting to rear its head as a priority for investors. We expect this price sensitivity will persist as other risks continue, putting a cap on multiple expansions. Going forward, earnings growth is expected to moderate quickly in the U.S. and Japan but may remain robust in Europe. It will be well into 2022 before we can get excited about Emerging Market equities based on expected earnings growth projections. The total impact of the revision cycle is to create downward pressure on equities. In combination with upward pressure on rates globally, creating competition for capital and potential shifts away from equity towards fixed income.

The Supply Demand Mismatch

Perhaps the greatest threat to a successful and smooth recovery remains the supply demand mismatch between the recovery in countries that primarily consume goods and those that primarily produce goods. The lack of vaccinations for poorer manufacturing countries like Vietnam and Indonesia are to blame for the inability to stock inventories for manufacturers of everything, from cars, to toys, to shoes, to clothing, to electronic goods. This also extends to mines and commodity operations in Latin America and Africa, driving up raw goods prices. This also extends to a shortage of workers in the logistics area where shipping transit times have doubled this past year. These factors are combining to drive up commodity prices, prices for intermediate goods, shipping and logistics, and wages, effectively reducing the total quantity of goods available to meet the pent-up pandemic demand that has amassed in the form of household savings in the U.S. and even in Europe and Japan. Most companies have successfully passed these costs through to consumers and margins have expanded since the beginning of the year across the globe; however, the lack of inventories will prevent the sales growth necessary to justify current price to earnings levels. Here, the U.S. remains expensive globally while emerging markets remain cheap, but as stated above, cheap for a reason. Though commodities may look attractive, commodity spikes are sudden and the resulting downward cycle is slow. This will continue to pressure margins in equities but will be unlikely to attract capital away from equities toward commodities as the futures curves for commodities point to gradually falling prices through 2022.

Monetary and Fiscal Policy

Global monetary policy is becoming less supportive with countries already announcing the end of pandemic stimulus and teasing rate hikes in 2022, now currently priced into the Fed Funds Futures market. This alone should create yield competition for assets. However, the ongoing debt-ceiling battle, drawn along party lines may threaten the very fabric of risk by throwing in the possibility of the first ever U.S. default. Keep in mind that when the U.S. lost its AAA rating in August of 2011, equity markets were flat for the remainder of the year and then shrugged it off for a stellar 2012. In addition, keep in mind that being at the bottom of the capital structure seems to ensure a very short-term memory when it comes to risk as long as crisis can be averted. However, traditionally in tightening environments, the outcome for equities can be good but not great while returns in fixed income markets over the same period can be very attractive on a risk adjusted basis. The main risks for this period continue to be inflation which could push the Fed to tighten earlier in 2022 than it is currently priced in. This risk has a real possibility but will likely rock the markets for more than a few months. The next risk is that Biden’s stimulus bill is not passed which is more of an upside risk as its passage would likely galvanize risk in the markets. The lack of passage just may mean more of the same choppy markets. The most impactful risk is that of a U.S. default, which has just narrowly been averted for now and pushed out to December. However, the chances of default continue to grow the longer it takes to get to a resolution, in which case, volatility may remain elevated through the end of the year at least and safe-haven treasuries will continue to rise in yields, making them slightly more attractive relative to current dividend yields offered in the equity markets. Yield and liquidity will dominate in these markets, driving allocations toward corporate and high yield markets as well as alternative sources of yield.

Net View

We remain neutral in U.S. equities on size and style. We also remain underweight in Emerging Markets relative to the U.S. and remain overweight in Europe to Japan, despite the recent outperformance of Japanese equities, which we see as a short-term event that will soon be overtaken by growth opportunities in Europe.