As inflation fears fade, we focus this month on the reopening.

The Big Neutral: Summary

- The reopening trade is a nuanced thing: while growth should be back in favor, it never went out of favor and market nervousness has driven value to lofty heights. This is not a normal cycle.

- Europe has quickly overtaken the U.S. in vaccination rates: cheaper valuations in Europe are far more attractive as the region looks poised to reopen.

- Reflation fading into the rearview mirror: transitory has turned out to mean less than three weeks as the bond markets reposition for higher rates, but lower inflation expectations.

Market Review: Back to Reality

Markets in June revealed a shift back to ground reality.

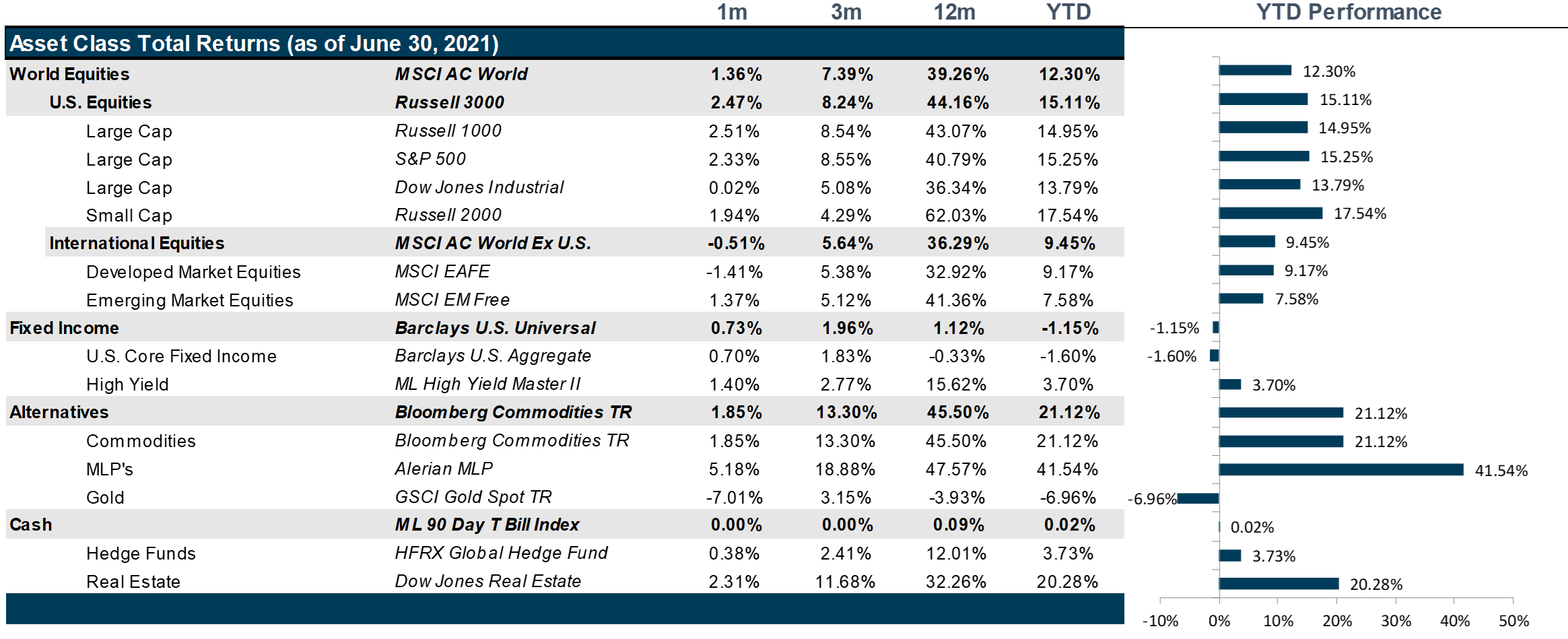

The U.S. markets touched new highs in June as investors remained bullish on the speed of economic recovery despite lingering concerns on short-term inflation due to the Consumer Price Index (CPI) rising by 0.6% in May. Change in nonfarm payrolls revealed that the U.S. economy added 559,000 jobs in May, up from April, but 116,000 short of economist expectations. Despite both the CPI and nonfarm payroll numbers falling short of expectations, the continued fall in weekly unemployment claims has kept the market sentiment buoyed, and the Federal Reserve has maintained the status quo by keeping rates unchanged as well as slowly starting to unwind their corporate bond holdings. Markets jittered when the Federal Reserve revised their estimates to two rate hikes by end of 2023, however a sudden spike in weekly jobless claims the same week pushed long term yields down and investors rushed back into the technology sector, which has emerged as the new beacon of stability during the pandemic. The real estate sector has continued to perform extremely well, returning 11.22% over the past 3 months, second only to technology. While the reopening economy is expected to boost the commercial real estate sub-sector, the sector as a whole has historically performed well during periods of recession thereby attracting investor interest. Towards the end of the month energy and banking stocks received a boost on news of the progress towards a bipartisan deal on President Biden’s massive infrastructure bill, and all participant banks clearing the Federal Reserve’s stress test this year, respectively.

The MSCI Europe Index has returned 2.85% over the past month and investors are expecting the continents’ major indexes to rise further as they emerge from lockdowns. While the delta variant has forced countries such as the U.K. to push back their reopening plans, the expectation that the reopening will have an identical effect on markets as it did in the U.S. has led to massive inflows from U.S. investors who hope to take advantage of the higher relative growth in the second half of the year.

MSCI Emerging Markets Index rose by just 0.51% in June, with the better performers including Brazil, Russia, South Korea and India. While many countries continue to struggle with COVID-19 variants, as the vaccination drive progresses, the impact of new strains on the population is expected to lessen. Emerging countries’ economies are expected to on average recover faster than their developed counterparts as the major emerging countries bypassed the traditional industrial stage and jumped right into a hybrid category of industrial-digital revolution. It is often easier to transition directly into newer technologies rather than trying to incorporate new ones into existing systems. China, the largest component of the MSCI EM Index was by far the biggest laggard as the government has clamped down on big tech for reasons ranging from anti-trust to data privacy to cybersecurity.

A low interest rate environment coupled with the Federal Reserve acting as a helicopter parent has emboldened investors in search of yields to continue pouring money into the high-yield bonds as opposed to investment grade bonds. Companies are taking advantage of the low rates to buy back bonds and estimates are putting new debt issuance in 2021 to be the highest of the past twenty years. While the news of the Federal Reserve revising their estimates towards two rate hikes by end of 2023 pushed up rates and temporarily drove out high-yield investors, a subsequent unexpected rise in weekly unemployment claims pushed down 10, 20 and 30-year yields by 12 bps, 16 bps and 19 bps each, reversing the prior outflows.

Commodities just like the rest of the market have been witnessing price spikes depending on the stage of economic recovery. Lumber prices spiked with the frenzy surrounding home buying, building, and renovating, leading to production shortages. However, with mills scaling up production to meet demand, lumber future prices have now dropped more than 40% over the past month. Oil prices rose above $75 per barrel in June, resulting in talks among the OPEC+ members on increasing production in August. However, prices are not expected to be stable in the near future as the Delta and Delta Plus variants surge across the world and the nuclear deal between the U.S. and Iran continues to remain on tenterhooks. In addition, while global crop production is expected to increase this year, a combination of high inflationary expectations and low humidity heatwaves across the Northern Hemisphere has pushed up crop future prices. Cryptocurrency prices continued to fall in June as financial regulators worldwide continue to crackdown on mining and transaction operations, while the sustainability momentum in the markets has brought to the front the massive energy consumption involved in mining cryptocurrencies.

Going Forward: The Big Neutral

When the World Health Organization first sounded the alarm on COVID-19, markets initially panicked in the vacuum of information combined with stringent lockdown measures, taking us back to levels in the U.S. stock market not seen since 2016. However, as we learned more about the virus, how it spread, how it could be controlled effectively causing many sectors of the economy to transition to working from home; the market clawed its way back up to pre-pandemic levels by the end of summer. And, although a fairly devastating second wave hit in the fall/winter, the outlook for a vaccine was looking positive and markets took the reopening for granted. It was coming. That said, cross markets remained bearish with lower risk assets rallying and higher risk assets treading water, vaccinations increased and lockdown measures were loosened. Meanwhile, vaccination accessibility remains a challenge in some parts of the world and a lack of urgency in other parts where the pandemic was well controlled through heavy handed lockdown measures. Either way, the U.S. remains an island in a global pandemic storm. And, the cross market bearishness remains a feature across the asset landscape.

Growth vs. Value

While value and growth at a reasonable price (GARP) style equity indices have been strong performers all year, it is worth noting that both styles are running hot, and well above sustainable long term averages. The catch up can explain some, but both are now well out of a range of comfort. Yet, growth, the seemingly ever over-priced segment of equities, is not that far below long-term fair value. This growth/value bet is essentially a coin flip at this point, so rather than get greedy, we close this trade out.

Follow the Vaccines

While the U.S. has managed a decent level of vaccinations, save pockets of vaccine hesitancy in the population, the results of the reopening are being felt across the markets from labor markets, to retail, to hotel, to travel. However, while Europe initially botched their vaccination rollout, Europe has largely overtaken the U.S. in terms of vaccination rates. Europe still has a significant amount of catching up to do and valuations are far more attractive, so this segment could continue to perform. However, in the international space, Japan remains a laggard with only 14% of the population fully vaccinated and only 25% of the population having received at least one dose with the Tokyo Olympics just around the corner. What should be a massive economic booster, could send the country into a spiraling lockdown. Perhaps the greatest convection we have is overweight Europe and underweight Japan. Emerging markets remains a decided lingerer and will likely remain so until COVAX, the global coalition run by the World Health Organization (WHO), the Coalition for Epidemic Preparedness Innovations (CEPI) and the Global Vaccine Alliance (GAVI) can make more vaccinations available in key hotspots.

Fading Reflation

Bonds have suffered the most in the reopening as anticipation of rate hikes have been moved up and concerns regarding inflation haunt the bond markets. Though high-yield has been a stand-out bond performer, it is a giant amount that dwarves. The continued upgraded cycle aided immensely by the availability of significant liquidity is likely to create some corporate zombies, but until the liquidity dries up (potentially in a few years), it will be hard to tell who is “swimming naked,” to harken back to one of Warren Buffet’s greatest dot com era quotes. Meanwhile, the yield curve is bear flattening with the short end rising in anticipation of higher interest rates and long end falling as the wind comes out of the sails of the reflation trade. This is not a great time to be a bank or be anywhere near bonds until the dust invariably settles.

Net View

We are closing out our small cap overweight as well as our Value and GARP overweights. We remain underweight Emerging Markets relative to U.S. and maintain a higher allocation to EAFE equities than usual, specifically Europe.