A review of the year 2020, the 20 years since Lido's founding, and what we are watching for in 2021.

How 2020 Changed the Money Paradigm

In the twenty years since Lido Advisors was founded, there have been a lifetime worth of events. The decade started with Y2K and the “dot com” turning into “dot bomb”. Unprecedented? Maybe technology mania was unique. Not so unique if you lived through the rise and fall of the “Nifty 50”, or any other boom-to-bust cycle.

The attacks on 9/11 were the first foreign attacks on U.S. soil since the bombing of Pearl Harbor, and they started our War on Terror. For several days after the attacks the stock market remained closed and fear and uncertainty escalated. We questioned if and when Americans would again live how we lived before the attacks. Eventually, the stock market re-opened, as did virtually every other kind of market.

During our most recent technological revolution, I am sure you have heard many experts’ express concerns that robots would take all the jobs. Perhaps you read an opinion or two that the demise of retail commerce due to the exponential growth of Internet commerce was eminent. In each case, the concerns and claims clearly missed the mark – by a wide margin.

In 2008, the financial crisis brought the world to its knees. There was a run on the banks, and some collapsed as the debt turned toxic. Unemployment instantly shot up to double-digit rates and real estate foreclosures reached an all-time high. Some predicted the beginning of a great depression. Others feared if the Government provided private bailouts, we run the risk of beginning of nationalism. The Government did provide bailouts, interest rates dropped, investors invested, and the world came to a “New Normal” with low interest rates, slow growth and asset inflation.

Throughout the last twenty years, Lido continued to guide, advise, and grow. We leveraged our continued and collective experiences, developing an expertise that continually refines and defines our guidance to clients. Even in our collective wisdom, though, Lido could never have predicted the future – especially the events that occurred in 2020 – but we were prepared for it.

Yet hindsight offers foresight.

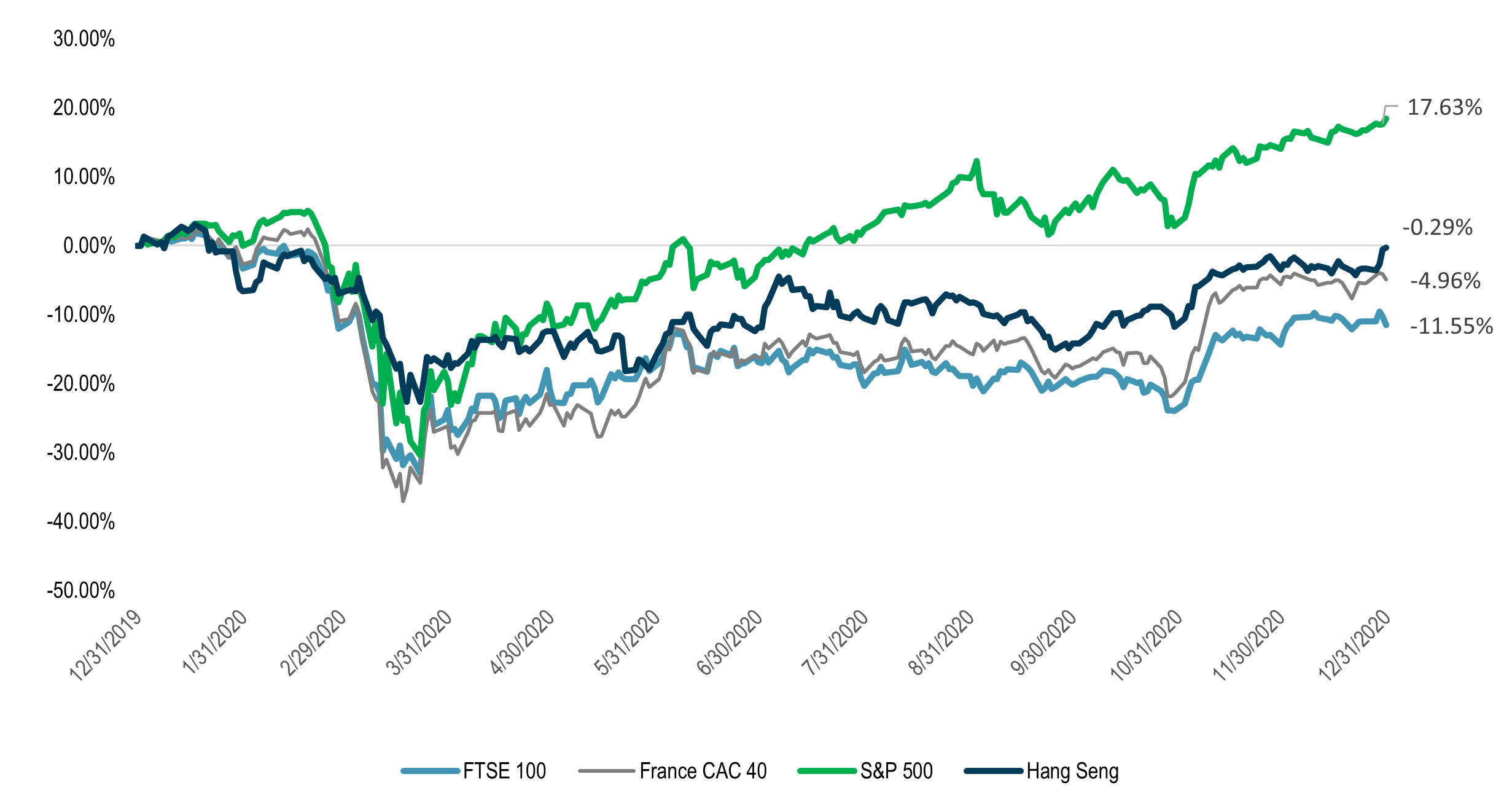

If you were told in February 2020 that there would be a worldwide pandemic with millions affected and we would largely be grounded for at least a year, what would you have done with your money? Be honest. I think most people would have buried their money -- and deep. Many more would have been surprised to see a broad-based stock index like the S&P 500 produce a double-digit positive for the year! Still deeper into the oddity is the discrepancy between indexes and returns throughout the world. Especially if you argue that the United States’ response was, at best, no better than many other leading countries.

Major Indices

Clearly there is an emotional aspect to money and behavioral economics suggests that emotions can and do play a role in how we manage our money. Cycles are just that – cyclical. Patterns develop. Feast to famine. Boom to bust. The appropriate question is, what about right now?

Is there a rational basis for why stocks are rising? Are there opportunities and what are the areas of concern?

Let’s examine some things we’re watching in the market today

Anticipating Future Growth

- The market is looking forward to strong gains this year.

- “Revenge travel”: People are ready and willing to get out!

Investors, Speculators, and Entrepreneurs

When markets shift and dislocate, investors and speculators look for opportunity. Entrepreneurs fill-in gaps and voids.

U.S. Stock Market

The U.S stock market offers a unique, liquid investment option. With worldwide demand, consistent pension contributions, low interest rates, and limited supply, the stock market continues to attract investors.

Looking at 2021

It sure is easy to report on what has happened. 2020 is hindsight. Literally. I couldn’t help myself.

In financial circles I hear and read so many commentaries about what can go wrong. How valuations are high. How growth will be stunted due to lingering COVID concerns. As valid as the concerns are, there are so many areas of opportunity. To be sure, we always should be mindful of the risk. Yet, the opportunities are vast and should not be overlooked.

Earlier I referenced booms and busts. Over the last twenty years, think of the innovation we have witnessed and embraced. Twenty years ago, you may have heard of an upstart online bookseller called Amazon, but you would not have heard about an exercise bike called Peloton. Chances are slim you would have been working out or walking around in a Lululemon outfit. Or driven an electric car – let alone have that car drive you. You would not have Zoomed into your meetings and social gatherings, and your phone probably was not smart yet. There was no vaccine for COVID-19. There was no COVID-19. Twenty years ago, Corporate Social Responsibility (CSR) was not a thing. Today, I am proud that Corporate and Social Governance is truly an important thing.

The message is: we will innovate. We will evolve. We will grow. Business and economic cycles can cause adversity or be met with opportunity.

Going into 2021, here are a few themes we are following.

Curb the speculation

Meaning, there are hot spots and excess. Keep some powder dry and some portion of the portfolio defensive.

Watch inflation and interest rates

If the economy does take off, price increases may follow. Higher prices might give the Federal Reserve an opportunity to tighten monetary policy. In general, the risk vs. reward on the long-bond is not appealing.

Big Growth

Big money is fueling big ideas. Life sciences, genomics, software, hardware and the Internet of things present compelling speculative opportunities.

We have an insatiable appetite for data and conductors to deliver the data. 5G is here.

People are living longer and are focused on wellness and healthcare.

We see promising trends in real estate. People are mobile. There is a shortage of home ownership, and new housing starts could fuel a whole new wave of innovative homeownership.

Selective International Investing

The growing middle-class will foster further demand in basic goods and services throughout the world. Basic industry, goods, and services all seem likely to benefit from this growth trend.

Pay attention to Washington

Regulation and tax discussions will likely be headline news. Investors don’t like uncertainty. Volatility created as a result of what happens in Washington should be looked at more opportunistically than pessimistically.

The future is as uncertain as it ever was. Will the new COVID-19 strain set us back? Will the vaccination program be effective? Will elected officials find some common ground? Is the rotation from growth into value real? Will we see higher rates? Inflation? These are all questions we must grapple with over the coming months. As these issues evolve, we will continue to take a probabilistic, data driven, economically grounded approach to managing assets. Why? Because it works.